GCC construction needs better New Year resolutions

A commonly held belief is that most New Year’s resolutions have been forgotten by the third week of January. While there seems to be little scientific basis for this time frame, the idea certainly makes for some interesting discussions in the break room. I am sure that construction leaders in the Middle East are eager to devise – and publicise – their business resolutions for 2019, but which items must they prioritise on their wish lists, which will undoubtedly impact the sector’s New Year plans for growth?

Goal-setting is a healthy exercise, both for business leaders and professionals, but to understand what we should pursue in 2019, it is important to review the shortcomings of 2018. Construction Week has published countless insights and news articles about the latter, tackling everything from payment delays to skills shortages, construction disputes, and market liquidity. We have heard from the Middle East’s top construction contracting bosses in 2018, and also had the opportunity to relay the concerns of the engineering staff working at these firms, which included issues such as low salaries and insufficient career development opportunities. With all this in mind, how can success be defined in 2019? At Construction Week, we have found that, regardless of position in the organisational hierarchy, it makes business sense to pursue productivity. For chief executive officers and managing directors, this means cutting costs and improving the bottom line. Professionals in mid- or junior-level roles might instead describe a successful year as one in which they received a promotion, or added an educational qualification to their CV. These different ambitions actually rely on quite similar tools and strategies. Construction experts around the world are adopting technology to make business operations more efficient and streamlined. In the region, building bosses are using cost management software to better track their finances, and the best of engineering supervisors are strapping on smart watches to remotely manage multiple worksites. Similarly, ‘lean’ principles are finding favour in the Middle East, with company leaders and employees alike using these management guidelines to improve the quality and efficiency of their output. Of course, technology is not the only answer to the problems that our industry might face in 2019. A smart watch or telematics-enabled truck will not protect a contractor against, say, the impact of low oil prices on market demand. However, regional megaprojects are nearing their completion deadlines, and the GCC’s economic diversificationmandates continue to drive developments. These opportunities may well protect engineering firms against the challenges they expect to face in 2019, but to truly succeed in the New Year, they will need more than just a set of resolutions that might not even make it to spring.

Project progress of 2018 will boost GCC construction in 2019

The team at Construction Week is often asked for advice on contemporary market conditions. Common enquiries are about whether a certain project has progressed, or if engineers will be paid more in the months to come. Of course, these answers depend on the insights that industry leaders share with us. For instance, over the last few months, Construction Week has observed regional construction leaders and advisors offering varying projections of the industry’s growth in 2019.

Some, such as Khalaf Al Habtoor, founding chairman of Dubai’s Al Habtoor Group, are optimistic about 2019, and have expressed confidence in GCC economies as diversification efforts gather steam and global oil prices note growth, despite a recent decline in value. Other market advisory sources, such as Colliers, believe that construction may become a more expensive activity in key regional markets, such as Saudi Arabia, next year. I may face some disagreement on this point, but I think of 2018 as a broadly positive period for the Gulf’s construction industry. We’ve seen some incredible projects – such as Warner Bros Abu Dhabi, Dubai Frame, Haramain Rail, and Muscat International Airport – being completed and delivered this year. Moreover, several contracts have also been awarded for large developments across the region in 2018, especially in the UAE’s and Saudi Arabia’s residential and commercial real estate sectors. Some regional leaders may have felt a shortage of market opportunities in 2018, and this sentiment may be particularly strong within the group that remembers the construction boom in the run-up to the oil price decline of 2014. However, steady progress was made on major under-construction developments this year, such as Expo 2020 Dubaiand Riyadh Metro. Indeed, these projects, alongside similar masterplanned communities in the Gulf – Madinat Al Irfan(Oman) or Silk City (Kuwait), for instance – will ensure that regional builders are busy in 2019 and beyond. Equally remarkable is the intangible progress made by the regional community in 2018. Dispute resolution and payment delays, the construction industry’s most impactful – and until recently, seldom discussed – pressure points, took centre-stage in 2018. Construction Week’s Dispute Resolution Question Time conferences held in Dubai and Abu Dhabi this year shed light on the importance of drafting proper contracts. As we reported in 2018, regional contractors are adopting a selective approach to bidding for new work, which bodes well for their finances in 2019. The best chief executive officers will tell you that intuition is as important as hard facts whilst doing business. It’s hard to predict whether 2019 will be an easier year for regional construction, but as the qualitative and quantitative growth of 2018 has shown, the prognosis is good.

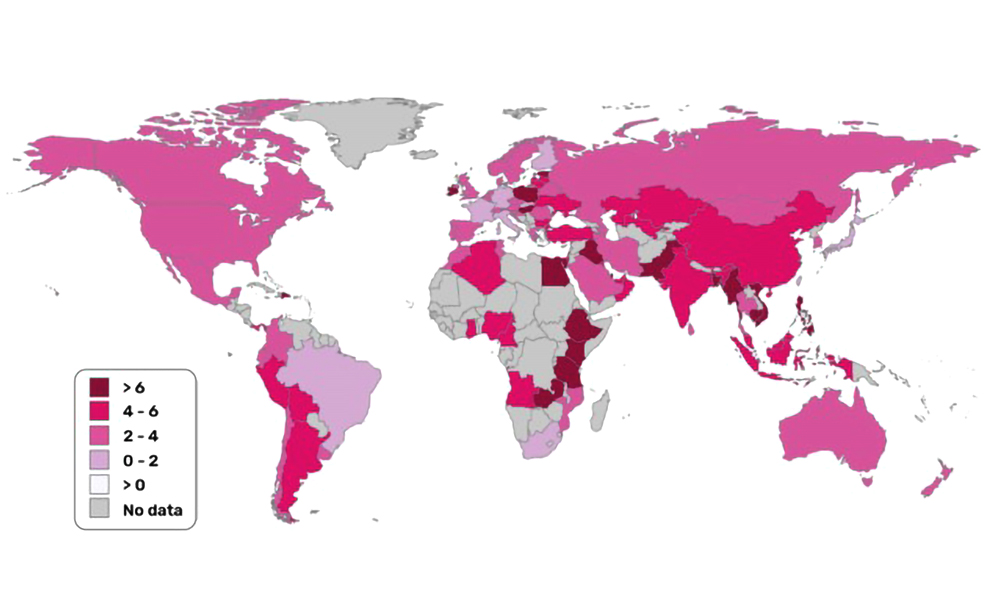

Global construction output to grow 3.6% per year until 2022 – report

Middle East to be among fastest-growing regions as worldwide output touches $12.9tr.