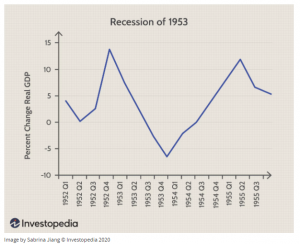

Economists describe recessions by their shape. The shape terminology simply characterizes how a recession looks in terms of its economic data on a graph. The most common recession shapes are V, U, W and L.

What is a V-shaped Recession?

What is a V-shaped Recession?

When an economy suffers a brief and sharp economic decline and then recovers well, this is a V-shaped recovery. This is in contrast with a U-shaped recession, which has a trough that isn’t as easily defined. In other words, it takes longer for an economy to come out of a recession.

The Economy and COVID-19

It’s evident throughout the world that the COVID-19 pandemic has had a dramatic and unprecedented effect on global economies. With businesses being forced to close, travel being restricted and a clear message to stay at home, the economy has shrunk dramatically in a span for a couple of months.

In the beginning of the pandemic, many economists hoped for a V-shaped recession. It was well known when travel was affected that there would be a dramatic effect on the economy, and the hope at that time was for a “temporary” crisis and a quick rebound. For example, in the UK, economy shrank by over 19% from March to May and the optimistic outlook was that the financial damage was short term. However, in July 2020, economists began to warn the media that a V-shaped recovery was looking increasingly illusive. Again taking the example of the UK, the economy only expanded by 1.8% in May although it was anticipated to bounce up to 5.5% and now, predictions show that the British economy will not go back to pre-crisis levels until the end of 2022!

However, any prediction of recovery is strongly depending on treatment, the public’s acceptance of the vaccine, and no appearance of any more strings of the same virus.

Disadvantages of a V-Shaped Recovery

Going back to the V-shaped recovery and even though it is looking quite unlikely, it is important to address its risks as some businesses are still hoping for a quick fix.

Many companies have faced serious leverage levels that are daunting. If the economy recovers as a V-shape, these businesses will fall off the radar without support. With a gradual recovery, businesses will have more time to adjust as demand starts to increase. Ona larger scale, it is important to consider national debt too as a result of the crisis. If we have a sudden V-shaped ‘swoosh’, it might mean that the recovery period and the upward trend do not last long enough for people to pay off their debts. The truth is that the country is going to have more debts than it ever has before, and even when the COVID-19 crisis is solved, the debts will still linger for a long time to come.

From a manufacturing perspective, the best example to support the argument against a V-Shaped economy is the 2016 crisis when the market was down and then back up overnight. This hit production facilities hard because they could not deliver products and meet demand – this caused a surge in prices and increased demand for second- hand machinery.

COVID-19 and hope for recovery

COVID-19 and hope for recovery

The first COVID-19 vaccines have been authorized for use and dissemination has begun in several countries, marking a major turning point in the pandemic and bringing fresh optimism for a next normal in the new year. These vaccines were developed four times faster than any other in history, but they will also require a rollout four times greater, amounting to the largest simultaneous global public-health initiative ever undertaken. Stakeholders face another hurdle to widespread vaccine adoption: some consumers remain skeptical of COVID-19 immunization. To reach herd immunity, McKinsey & Company have concluded in their report titled “COVID-19: Implications for business” that adoption ranges would need to be greater than those of vaccines for the flu and other diseases to an approximate 58% to 94% higher.

Nonetheless, since the announcement of a vaccine, CEOs continue to develop their COVID-Exit strategies, McKinsey & Company have analyzed how companies have found a successful COVID-Exit path with transformations that balance portfolio moves and performance improvements. A new global survey of more than 800 executives reveals that companies are prioritizing business building for organic growth, launching new businesses at an accelerated rate and, in turn, growing faster. The strongest companies are also reinventing themselves through next-normal operating models, capitalizing on this malleable moment and the resulting spread of agile processes, nimbler ways of working, and increased speed and productivity.

While that’s highly positive news, McKinsey’s research also finds that the new vaccines are likely to accelerate only slightly the timetable to the end of the pandemic. In the United States, normalcy is not likely until the second quarter of 2021, and herd immunity is not likely until the third quarter. In other words, the pandemic will not be vanquished soon, and businesses will continue to be challenged.

The most likely scenario is a U-shaped recovery – with so much uncertainty and the second wave upon us, it is quite possible for many businesses will close or even worse declare bankruptcy again leading to fewer jobs. With these factors taken into consideration, consumers will not have the spending power that they did pre-coronavirus crisis.

For a V-shaped recovery, we would have to reopen the whole economy at the same time, and life would have to resume to pre-crisis status financially, socially and psychologically , i.e. no changes in habits in terms of going to bars, shopping, travelling, sports arenas, etc. This is increasingly less likely, given what we now know of COVID-19.

Recovery Steps

Recovery Steps

Back in April, Janet Yellen, the former Federal Reserve Chair, told CNBC that she believed a V-shaped recovery was possible: “I think a ‘V’ is possible, but I am worried that the outcome will be worse and it really depends to my mind on just how much damage is down during the time that the economy is shut down in the way it is now,” Yellen said. That will be determined by whether employers can bring workers back quickly and if consumers aren’t too badly damaged to return to spending once social distancing associated with the coronavirus is rolled back.

“The more damage of that sort is done, the more likely we are to see a ‘U,’ and there are worse letters like ‘L,’ and I hope we don’t see something like that,” Yellen said.

On top of this, businesses are now having to make decisions on whether or not COVID-19 is a seasonal problem, which could mean problems for many years to come. When businesses don’t have confidence in the economy and the public’s opportunities for spending, it means that they hold back.

Only time will tell what shape the economic recovery of COVID-19 will be!

End.

Sources:

https://www.investopedia.com/terms/v/v-shaped-recovery.asp

https://www.theguardian.com/business/live/2020/jul/14/uk-economy-gdp-growth-may-covid-19-markets-ftse-business-live

https://www.cnbc.com/2020/04/06/janet-yellen-says-second-quarter-gdp-could-decline-by-30percent-and-unemployment-is-already-at-12percent-13percent.html

https://www.mckinsey.com/business-functions/risk/our-insights/covid-19-implications-for-business#

Following the mega event that occurred in Abu Dhabi on November 27th where Modon Properties, the UAE-based developer of sustainable residential communities, had set a new Guinness World Record title for the ‘Tallest building demolished using explosives (controlled demolition), with the successful razing of Mina Plaza towers in the Mina Zayed area, Abu Dhabi, we thought it fitting to talk about demolition and tower cranes.

Following the mega event that occurred in Abu Dhabi on November 27th where Modon Properties, the UAE-based developer of sustainable residential communities, had set a new Guinness World Record title for the ‘Tallest building demolished using explosives (controlled demolition), with the successful razing of Mina Plaza towers in the Mina Zayed area, Abu Dhabi, we thought it fitting to talk about demolition and tower cranes.

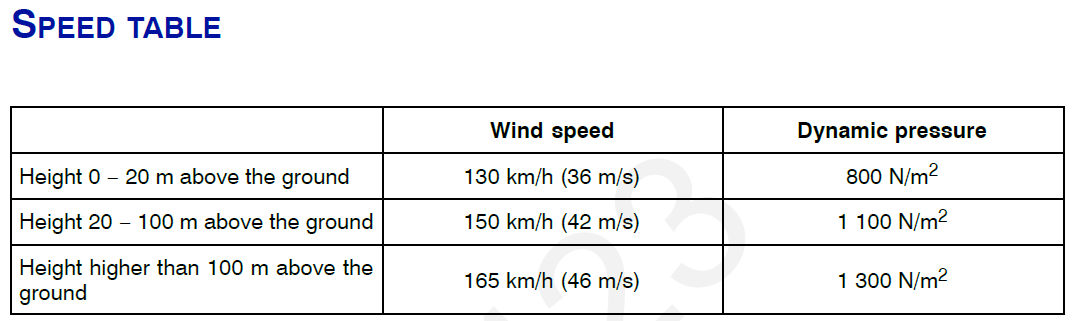

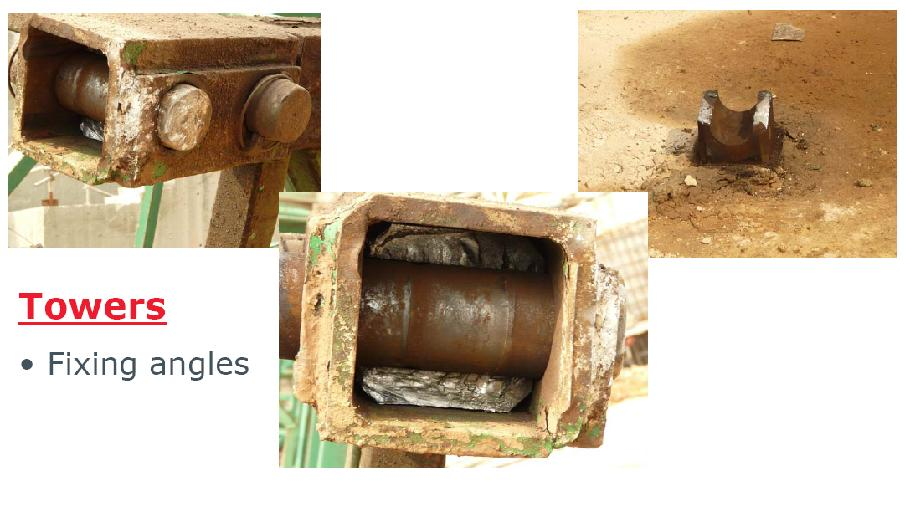

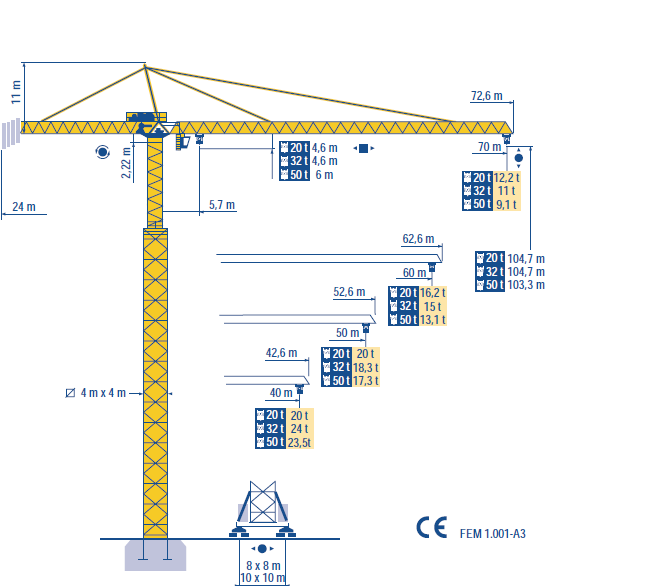

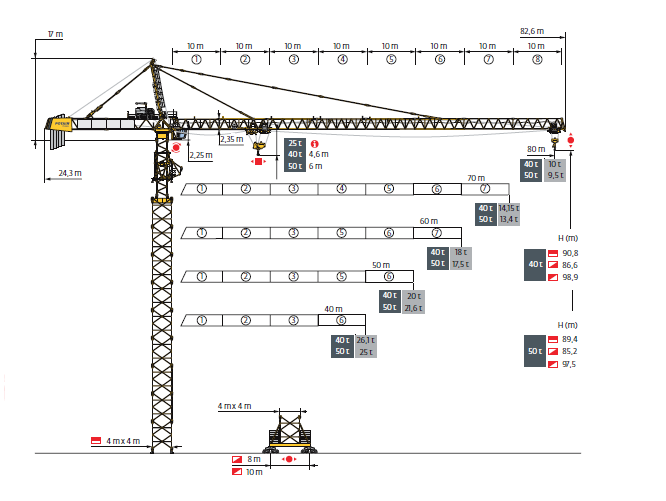

The foundation is an integral part of the tower crane as it is what holds the crane steady. It’s important that the tower crane’s foundation and structural supports are designed by either a professional structural engineer, specialized in foundation design. At NFT we always encourage contractors to have the foundation designed for an expert who will follow the manufacturer’s manual and recommendations and design based on reactions provided by the manufacturer. If there is concrete in the foundation for fixing angle, the design of the concrete needs to be done by an expert and is the sole responsibility of the contractor.

The foundation is an integral part of the tower crane as it is what holds the crane steady. It’s important that the tower crane’s foundation and structural supports are designed by either a professional structural engineer, specialized in foundation design. At NFT we always encourage contractors to have the foundation designed for an expert who will follow the manufacturer’s manual and recommendations and design based on reactions provided by the manufacturer. If there is concrete in the foundation for fixing angle, the design of the concrete needs to be done by an expert and is the sole responsibility of the contractor.

the Clement Canopy in Singapore. It is a residential condominium located along Clementi Avenue 1 and in the vicinity of three schools and other residential blocks. The project combines both traditional construction methods and the PPVC. Conventional construction methods took place on the basement floor, multi-storey car park and first floor of the blocks, whereas, the 2nd to 40th floors adopted PPVC. The Clement Canopy is currently the tallest PPVC concrete building in the world.

the Clement Canopy in Singapore. It is a residential condominium located along Clementi Avenue 1 and in the vicinity of three schools and other residential blocks. The project combines both traditional construction methods and the PPVC. Conventional construction methods took place on the basement floor, multi-storey car park and first floor of the blocks, whereas, the 2nd to 40th floors adopted PPVC. The Clement Canopy is currently the tallest PPVC concrete building in the world.