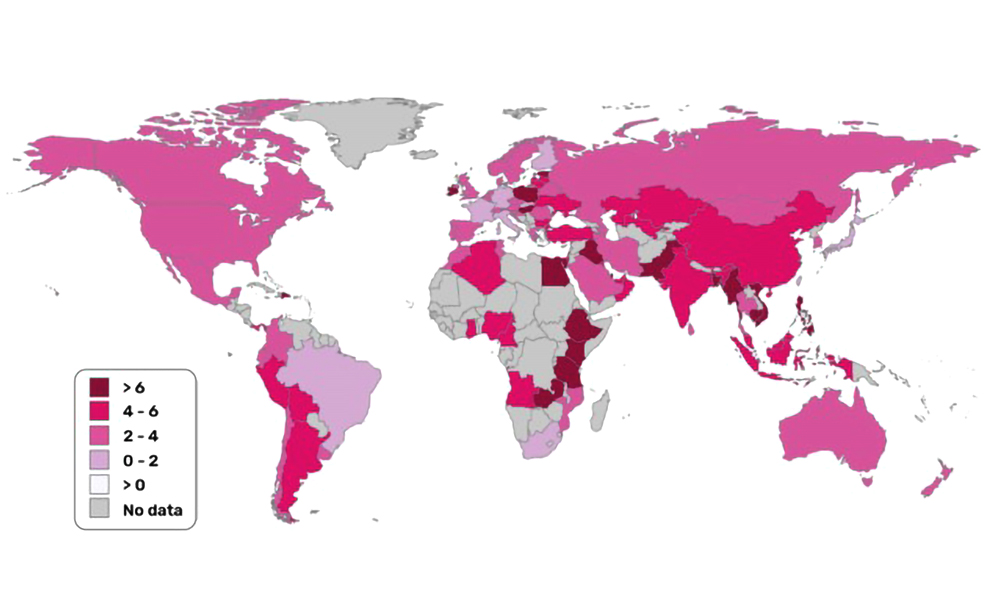

The new coronavirus outbreak has hit the economy hard. With businesses closing, city curfews, manufacturing shutdowns, there has been a detrimental effect on the global economy. Here’s a summary of measures taken by countries and construction companies to address the pandemic.

There is a lot of uncertainty when it comes to dealing with the coronavirus pandemic, especially for contractors and small businesses in the construction industry. It’s important for any business, especially companies whose work involves going into people’s homes and places of business, to act when an unpredictable pandemic like coronavirus suddenly emerges. While many businesses have been forced to halt operations indefinitely, some essential businesses, which in many states includes construction (critical trades), are still operating. To better protect themselves, their employees, and their clients, those business owners should consider the following tips.

TAKE YOUR HEALTH SERIOUSLY

During times like this, no potential signs of the virus can be allowed on the jobsite. If anyone is displaying acute respiratory symptoms (e.g., coughing, fever or shortness of breath), they pose a potential virus transmission risk. No one should return to work until their temperature is lower than 37.8° C for at least 24 hours and they feel well enough to do their job effectively.

For businesses with more than one employee, owners should review sick-leave policies and make sure they are flexible enough to accommodate the current environment. It might not be the employee, but their family member, that ends up sick, so be prepared for people to have to miss work to care for a sick child or relative. Finally, waive any requirements for notes from health care professionals to validate illness. Physicians’ offices and medical facilities are extremely busy, and those requests are not their priority.

BE PROACTIVE WITH PREVENTION

Viruses and bacteria can linger almost anywhere for hours, so regularly wipe down cell phones, workstations, handles, doorknobs, truck interiors and tools with a disinfectant. Contractors should wash their hands with soap and water for at least 20 seconds at least three to four times throughout the day and avoid touching their faces. If possible, purchase 60% to 95% alcohol-based hand sanitizer and apply it in addition to regular hand washing.

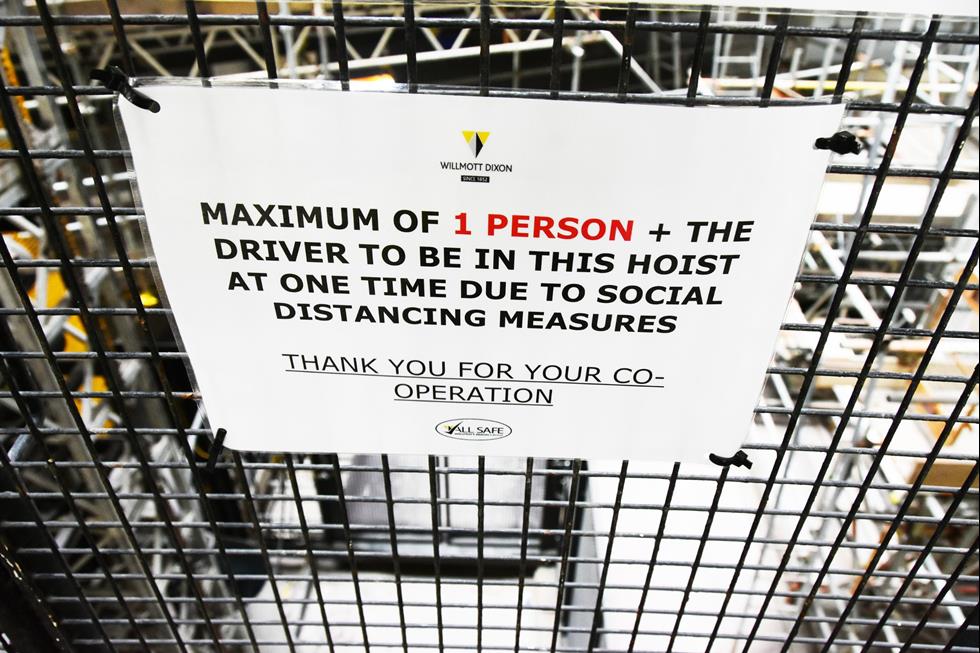

FOCUS ON SOCIAL DISTANCING

With many businesses temporarily closed and a lot of people working from home, there may be opportunities to take on projects in vacant office spaces or businesses. If contractors can pivot to those types of projects, they are protecting themselves, their families and the general public. For projects that involve contact with other people, contractors should be sure to follow guidelines about maintaining two meters of distance.

TRANSITION TO PAPERLESS PROCESSES

Another way to practice social distancing during this time is to work towards going paperless and automating business processes that were previously handled manually. Contractors can upgrade the tools they use to conduct everyday business, such as mobile invoicing and estimating, as well as add an easy online option for payments. This will reduce the amount of person-to-person contact and enforce social distancing protocols by eliminating the need to collect checks in person or visit a crowded bank. By moving more functions online, contractors can show they are adapting to the current environment, as well as create efficiencies that are effective now and will continue to be in the future.

STAY INFORMED ABOUT THE NEWS OF THE DAY

With COVID-19 making headlines every morning and information changing hourly, it’s important to have the most up-to-date information. Staying on top of breaking developments will help contractors make better-informed decisions regarding their day-to-day operations and help them prepare for the impacts of new safety measures and restrictions. Contractors staying informed on, and following, the latest recommendations from health care professionals and government officials will also demonstrate that they are taking the situation seriously and give customers peace of mind about working with them.

SET UP A CRISIS MANAGEMENT TEAM

Ideally, this would constitute of senior managers from HR, Admin, HSE, and Finance. Get the full team aligned with the true severity of the macro COVID-19 situation and worst-case financial scenarios. The Crisis team should set safety as the number one priority and set cash conservation and liquidity as a secondary priority. Avoid inaction or “wait and see” approach which could damage the company. The team should have an Agile Methodology in announcing policies and mode of operations.

PLAN URGENT COST CUTS TO CONSERVE CASH

You can control the sending hand brakes by initiating immediate actions (e.g. hiring freeze, opex, capex, working capital). Similarly, set aggressive break-the-glass cost actions triggered by more extreme revenue scenarios. Outline a medium-term plan to lean out the cost structure for the future. It should be a plan that is more automated, more variable and, more shock resistant.

STABILIZE OPERATIONS FOR THE NEW NORMAL

Stabilize supply chains of physical goods from likely geographic and labor disruptions while building contingency operational plans for all aspects of the business.

BE UP FRONT WITH SUPPLIERS/CUSTOMERS ABOUT THE LATEST POLICIES

Many contractors and small construction businesses will likely have to pause their work at some point because of safety recommendations. When that happens, it will be vital that they communicate quickly and clearly with their suppliers about why projects have to be delayed, an updated timeline if possible and what suppliers can expect moving forward. Regularly calling suppliers with updates will also go a long way in maintaining that relationship in the long term.

LOOK AT THE BIGGER PICTURE

It’s the hallmark of a great business owner to keep things in perspective and not allow the quick tempo of the current situation to affect the company’s priorities. Along with listening to and being there for clients and employees, business owners should be a source of steady guidance. The current obstacles are temporary, but clients and staff won’t forget effective, calm leadership. This is an opportunity to learn, work together and become stronger in the long run. Viewing it as such will benefit contractors, clients and the industry as a whole.

What about Government Measures taken during the COVID-19 crisis?

Europe’s construction sector has issued a joint statement calling for urgent measures to protect workers’ health, support economic activity and help the sector to recover in the wake of the Coronavirus pandemic. Specific short-term measures requested of European Member States are as follows:

- Put in place tailor-made health and safety measures, protocols and guidelines with the active involvement of relevant stakeholders

- Support the construction supply chain by putting in place measures allowing the efficient functioning of the EU (European Union) internal market

- Carry out massive support and stimulus program

- Ease the administrative burden and the conditions for employers to implement temporary unemployment measures.

The statement added: “A performing construction supply chain is crucial for maintaining the activity, with proper health and safety conditions. It is therefore essential to guarantee the circulation of construction products; equipment and provision of services in full respect of the instructions delivered by public health authorities.

The UAE has proved to be an example of countries’ proactive initiatives to addressing the pandemic.

- Complete sterilization of public spaces. Dubai’s Roads and Transport Authority (RTA) has completed the sterilization of the Dubai Metro and the Dubai Tram. This includes all 47 metro stations, 79 trains, 11 tram stations and Dubai Trams. The RTA will also be sterilizing its 1,372 buses, five bus depots and 17 bus stations. The sterilisation covered the entire fleet of Dubai Taxi, limousines and shared transport (smart rental) operating in Dubai, which exceed 17,000, as per the RTA. Roads and Transport Authority has taken all the necessary preventive measures during the past few weeks to ensure the highest levels of protection for users of public transportation, whether through continuous sterilization and cleaning operations for all of these means, or through the precautionary measures that it imposed and began applying in regulating transportation use Public and ensure physical separation and other measures aimed at preserving health and safety for all, and reducing the chances of spreading the virus.

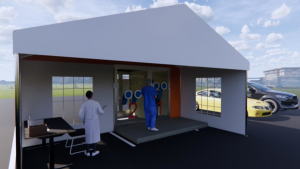

- Screening Facility, drive-thru testing in Abu Dhabi and Dubai. Taking the new centre developed by Abu Dhabi Health Services Company-SEHA, allow for The mobile testing facility to dedicate efforts for testing individuals for coronavirus, as part of the country’s precautionary measures to address the spread of COVID-19.Checks are done in 5 minutes, while the center provides services to about 600 people daily starting from 8am to 8pm daily.

- Increased regulations to promote social distancing by closing all leisure industries and imposing lockdowns and curfews. To support the current precautionary measures in cooperation with the Health Authority, the TRA (Telecommunication Regulatory Authority) in coordination with the service providers launched an awareness voice message when making a phone call, and SMS alerts sent 30 minutes before the lockdown and again 1 minute before lockdown. In Dubai, the 24 hour sterilization campaign will last for 2 weeks during which only vital industries such as healthcare, supermarkets, logistics and construction are active, and this is controlled through the issuance of permits.

- Drivers of cars need to be wearing masks and only 3 passengers are allowed in sedans, and a 20% reduction of capacity in buses.

- Labor camps are under strict scrutiny to test all suspicious employees

In addition to the focus on tackling the spread of the coronavirus, the UAE government is also addressing head on any collateral damage resulting from the economical slowdown. On April 4th, the UAE’s central bank doubled its banking stimulus package to US$70 billion as business sentiment eroded in the Gulf’s commercial centre. The announcement followed new measures to guarantee liquidity in the banking system. The package expanded on a previously announced AED126 billion (US$34.3 billion) program to assist its lenders. The central bank has also postponed the planned implementation of certain Basel III capital standards to 31st March 2021 for all banks with the aim of diminishing the operational burden on the financial industry. The overall stimulus which consists largely of monetary and off budget measures account for more than 10% of the UAE’s economy. On April 1st, the UAE cabinet announced additional measures, notably improving payment terms for contractors involved in government contracts as well as exempting companies from any fines that accrue from any delays caused by the COVID-19 virus. For payments, the cabinet instructed federal ministries and bodies to pay contractors and suppliers within 15 days; while for contract delays, suppliers impacted by COVID-19 are exempted from fines for delays on federal government contracts for a renewable period of three months. The cabinet also directed that small and medium suppliers will be awarded 90% of federal government purchases. Those measures come after the UAE cabinet approved a US$4.4 billion economic stimulus package that includes a renewable six-month suspension of work permit fees and reduction of labor and other charges that aim to accelerate major infrastructure projects across the federation. On March 16th, the Central Bank of UAE (CBUAE) lowered key lending rates, following a 1% rate cut by the Fed to counter the economic effects of COVID-19, which will adversely impact profitability of UAE banks, according to rating agency Moody’s. Leading Dubai banks have announced a series of relief measures for customers affected by COVID-19

In addition to the focus on tackling the spread of the coronavirus, the UAE government is also addressing head on any collateral damage resulting from the economical slowdown. On April 4th, the UAE’s central bank doubled its banking stimulus package to US$70 billion as business sentiment eroded in the Gulf’s commercial centre. The announcement followed new measures to guarantee liquidity in the banking system. The package expanded on a previously announced AED126 billion (US$34.3 billion) program to assist its lenders. The central bank has also postponed the planned implementation of certain Basel III capital standards to 31st March 2021 for all banks with the aim of diminishing the operational burden on the financial industry. The overall stimulus which consists largely of monetary and off budget measures account for more than 10% of the UAE’s economy. On April 1st, the UAE cabinet announced additional measures, notably improving payment terms for contractors involved in government contracts as well as exempting companies from any fines that accrue from any delays caused by the COVID-19 virus. For payments, the cabinet instructed federal ministries and bodies to pay contractors and suppliers within 15 days; while for contract delays, suppliers impacted by COVID-19 are exempted from fines for delays on federal government contracts for a renewable period of three months. The cabinet also directed that small and medium suppliers will be awarded 90% of federal government purchases. Those measures come after the UAE cabinet approved a US$4.4 billion economic stimulus package that includes a renewable six-month suspension of work permit fees and reduction of labor and other charges that aim to accelerate major infrastructure projects across the federation. On March 16th, the Central Bank of UAE (CBUAE) lowered key lending rates, following a 1% rate cut by the Fed to counter the economic effects of COVID-19, which will adversely impact profitability of UAE banks, according to rating agency Moody’s. Leading Dubai banks have announced a series of relief measures for customers affected by COVID-19

Contractor Case Study: The example of RAQ Contracting

The pandemic has impacted almost all sectors and industries, posing severe challenges for businesses, including the contracting companies, like RAQ Constracting. The supply chain for special items required by the construction industry has been affected as many vendors, suppliers, and manufacturers have either stopped working or are working in reduced capacities. One of the most immediate challenges was the reduced capacity on UAE’s transport infrastructure, resulting in labor shortages and productivity on project sites. To combat this, RAQ provided additional vehicles and buses for staff transportation and some making multiple trips during the day to ensure healthy progress on site. Understanding the critical nature of the current situation, RAQ has begun conducting COVID-19 awareness sessions to its staff and workers in order to keep operations running in a safe environment. RAQ persists during the COVID-19 crisis by carrying out a deliberate strategic plan and keeping projects’ progression in check, along with ensuring the well-being of the employees. The Contractor is committed to doing its part by ensuring the health & safety of its employees and visitors by following these guidelines:

- Check-in/out is done through iris or facial recognition instead of biometrics

- Forehead temperature of employees and visitors are taken by an infrared thermometer and recorded for the HSE heads to take action if required

- Personal items, desks, chairs, and other unattended items are being disinfected before and after working hours on all sites

- Social distancing is practiced among employees and other visitors. Employees who can work remotely are encouraged to stay home to maintain working individuals at the office to “essentials only.”

- Hand sanitizing dispensers are placed at entrances and exits of every room.

- Pantry staff must wear gloves and masks at all times

- Self-quarantine is imposed on employees experiencing symptoms or returning from travel

- Staff and workers dorms along with site offices are undergoing periodic disinfection

- RAQ had implemented a new seating chart policy for its employees to reduce the office capacity by 30% and ensure that social distancing is practiced

- Personal Protective Equipment (PPE) are being distributed daily amongst RAQ employees

- Furthermore, all transport vehicles are disinfected regularly, and commonly touched surfaces are sanitized twice daily. Hand sanitizing dispensers are fixed on all vehicles. To ensure that regulations to adhere to strictly, a clear instruction list has been issued to all transportation/logistics and sites to reduce the capacity to 25% in all transport vehicles.

Supplier Case Study: The example of NFT

Supplier Case Study: The example of NFT

At NFT, we are committed to our customers, employees and communities.

Our occupational activities are relatively safe and in line with provisions taken to combat spread of COVID-19. We work with steel structures in open spaces that are exposed to the sun and high heat, which makes it resistant to spreading of the virus by nature. However, the exposure remains with the human element outside those activities such as commuting to work and personal lives’ activities. This is why we are monitoring closely the latest developments surrounding the coronavirus COVID-19 pandemic, and updating our action plans with full vigilance according to the latest protocols of health and safety shared by the UAE authorities as well as international recommendations. The health and safety of our employees and customers are and have always been our number one priority.

First step in facing any hazard is to conduct risk assessments and act according to the scientific recommendations to tackle the hazards. Our response covered several aspects to insure safety of our employees as our prime concern, and continuation of flow or work as long as the construction sector is still active in the UAE. We adjusted our modus operandi and adopted several work procedures according to International Recommendations and mitigation measures mandated by the UAE Government. Our updates, guidelines and recommendations come from trusted sources who are experts in the field, such as Department of Health in the UAE, World Health Organization (WHO), or Centers for Disease Control and Prevention (CDC).

First step in facing any hazard is to conduct risk assessments and act according to the scientific recommendations to tackle the hazards. Our response covered several aspects to insure safety of our employees as our prime concern, and continuation of flow or work as long as the construction sector is still active in the UAE. We adjusted our modus operandi and adopted several work procedures according to International Recommendations and mitigation measures mandated by the UAE Government. Our updates, guidelines and recommendations come from trusted sources who are experts in the field, such as Department of Health in the UAE, World Health Organization (WHO), or Centers for Disease Control and Prevention (CDC).

From the very early stages, we set up Crises Management Committee formed from out top management, QHSE, Administration, Operations, and HR departments. The job of this committee is to follow up on the current situation, development of COVID-19, contact with UAE officials, contact with our sister companies overseas, and come up with measures in line with the official recommendations. NFT conducted more than 15 dissemination and awareness sessions about the virus and methods to control its spread to different groups in multilanguages. We made sure that the sessions we tailored to each group to reach all our employees and each in their vocation. Special attention sessions and trainings were conducted with sanitation people, drivers, or the more vulnerable groups who can be more exposed as per our risk assessment surveys. In addition, flyers, posters, videos, and publications were circulated wherever possible inside the offices, workshop, vehicles, and even labor camps dormitories.

From the very early stages, we set up Crises Management Committee formed from out top management, QHSE, Administration, Operations, and HR departments. The job of this committee is to follow up on the current situation, development of COVID-19, contact with UAE officials, contact with our sister companies overseas, and come up with measures in line with the official recommendations. NFT conducted more than 15 dissemination and awareness sessions about the virus and methods to control its spread to different groups in multilanguages. We made sure that the sessions we tailored to each group to reach all our employees and each in their vocation. Special attention sessions and trainings were conducted with sanitation people, drivers, or the more vulnerable groups who can be more exposed as per our risk assessment surveys. In addition, flyers, posters, videos, and publications were circulated wherever possible inside the offices, workshop, vehicles, and even labor camps dormitories.

Highest risks and challenges occur while commuting to work or living in labor camps that have high concentration of people. With the extraordinary efforts of the health authorities in the UAE, we managed to screen all our working force and implement extra precautions in collaboration of labor camps management. Commuting to work according to the UAE authorities directives, follows 30% occupancy in the vehicles. Effectively it means, we tripled our busses to labor camps, we increased our fleet/trips of small vehicles and minibuses. In addition, we added separate plastic sheet inside the busses in order to separate the driver from the passengers. Deep disinfection is carried out for the whole yard periodically and upon need. On the other hand, all teams were divided into segregated

Highest risks and challenges occur while commuting to work or living in labor camps that have high concentration of people. With the extraordinary efforts of the health authorities in the UAE, we managed to screen all our working force and implement extra precautions in collaboration of labor camps management. Commuting to work according to the UAE authorities directives, follows 30% occupancy in the vehicles. Effectively it means, we tripled our busses to labor camps, we increased our fleet/trips of small vehicles and minibuses. In addition, we added separate plastic sheet inside the busses in order to separate the driver from the passengers. Deep disinfection is carried out for the whole yard periodically and upon need. On the other hand, all teams were divided into segregated  groups that work in isolation from each other. In case any symptoms appear on any of the team members, the one with symptoms would go for check up, while the others in the same team would be sent to self-isolation until further verification of the health conditions. Meanwhile, the job would be carried out with another group, hence keeping work flow uninterrupted.

groups that work in isolation from each other. In case any symptoms appear on any of the team members, the one with symptoms would go for check up, while the others in the same team would be sent to self-isolation until further verification of the health conditions. Meanwhile, the job would be carried out with another group, hence keeping work flow uninterrupted.

In parallel, the same measures were conducted to maintain social distancing in the office, when possible the employees could carry out their jobs without the need to come to office. In case coming to office is essential, we restructured the office distribution as to maintain necessary social distancing as recommended. An infrared gun thermometer was placed at the reception for all those entering to voluntarily check their temperatures. A special team is deployed for disinfecting all surfaces, office appliances, door knobs, handles, restroom facilities, round the clock during working hours. Paper circulation was reduced to minimum, and when necessary special disinfected plastic files were used to carry the papers.Masks and gloves are distributed in different types and frequency according to the risk analysis.Special awareness sessions and measures are put in place for the more Vulnerable people (by virtue of their age, underlying health condition, clinical condition or are expecting). They follow the highest strict precautions.Fingerprinting for sign in/out were temporarily deactivated and replaced with photo/ web sign in/out.Provided additional handwashing facilities with soap, and if not available hand sanitizing solutions, especially in vehicles, and at building hallways, entrances, and exits.We increased rubbish bins number and rubbish collection, and spread them in order to reduce any remaining.We reduced site meetings to absolute necessary ones whether external meeting or internal. When possible, we use virtual meetings using technology as Microsoftteams.

In parallel, the same measures were conducted to maintain social distancing in the office, when possible the employees could carry out their jobs without the need to come to office. In case coming to office is essential, we restructured the office distribution as to maintain necessary social distancing as recommended. An infrared gun thermometer was placed at the reception for all those entering to voluntarily check their temperatures. A special team is deployed for disinfecting all surfaces, office appliances, door knobs, handles, restroom facilities, round the clock during working hours. Paper circulation was reduced to minimum, and when necessary special disinfected plastic files were used to carry the papers.Masks and gloves are distributed in different types and frequency according to the risk analysis.Special awareness sessions and measures are put in place for the more Vulnerable people (by virtue of their age, underlying health condition, clinical condition or are expecting). They follow the highest strict precautions.Fingerprinting for sign in/out were temporarily deactivated and replaced with photo/ web sign in/out.Provided additional handwashing facilities with soap, and if not available hand sanitizing solutions, especially in vehicles, and at building hallways, entrances, and exits.We increased rubbish bins number and rubbish collection, and spread them in order to reduce any remaining.We reduced site meetings to absolute necessary ones whether external meeting or internal. When possible, we use virtual meetings using technology as Microsoftteams.

Manufacturer Case Study: The example of Terex

Manufacturer Case Study: The example of Terex

Guided by the Terex Way values, the tower crane supplier is working hard to ensure business continuity while following strict preventive guidelines to ensure everyone’s safety. They continue with shipping equipment, the fabrication of parts and the full operation of service centers. Globally, the parts customer service is open with team members working remotely, equipped with the required tools and access to respond to customer inquiries through a number of channels, including parts.terex.com for Materials Processing businesses, gogenielift.com for Genie, utilitiesparts.terex.com for Terex Utilities, and Terex Service Centers, call centers and other flexible delivery alternatives. However, Terex has temporarily suspended manufacturing operations in certain locations, responding to changing customer demand and complying with government mandates to close facilities. Nonetheless, this has not stopped the manufacturer from releasing their field service team from supporting customers on site. Technicians are supporting customers and others virtually (e.g., phone, video conference) as much as possible

An Opportunity amidst the crisis

It should come as no surprise that the COVID-19 global pandemic hasn’t impacted all industries equally. Some businesses, including department stores, traditional restaurants and childcare centers, have suffered devastating losses as a result of stay-at-home orders and social distancing protocols; others, such as food delivery businesses, digital advertising agencies and subscription services, are experiencing unprecedented surges in sales.

As example is Saudi Arabia’s local online retailer BinDawood Holding who, since the escalation of the Covid- 19 crisis, has had average sales on a 10-day basis increase by 200%, while its average order value rose by 50% and app installations by 400%. The company has two e-commerce platforms – BinDawood and Danube – which are connected to their respective supermarket and hypermarket chains, enabling customers to purchases groceries and other goods online.

Elsewhere, fellow Saudi grocery delivery app Nana has also benefitted from the recent turn towards online shopping, raising $18m in a Series B funding round in late March to expand operations across the Middle East, with investors including venture capital funds Saudi Technology Ventures and Middle East Venture Partners. This follows a Series A funding round that raised $6m last year. The company has expanded capacity three-fold following a surge in demand associated with the Covid-19 outbreak. This is expected to continue in light of the Saudi government’s decision to impose tighter curfews in major cities.

The surge of video conferencing is remarkable. An example is the Zoom, who despite scrutiny over security issues, has seen its market value skyrocket to some $35 billion. As people around the world stay home due to coronavirus risk, Zoom has become a go-to service for remote education, exercise classes, games, church services and happy hour celebrations. Couples have gotten married in “zoomed” ceremonies. Birthdays have been celebrated. Funerals have been virtually attended.

The surge of video conferencing is remarkable. An example is the Zoom, who despite scrutiny over security issues, has seen its market value skyrocket to some $35 billion. As people around the world stay home due to coronavirus risk, Zoom has become a go-to service for remote education, exercise classes, games, church services and happy hour celebrations. Couples have gotten married in “zoomed” ceremonies. Birthdays have been celebrated. Funerals have been virtually attended.

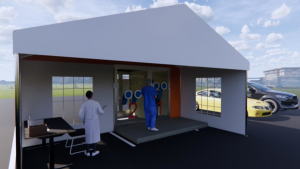

In addition to the increase in production of PPE and flu fighting supplements and medication, there is an increasing trend of building remote testing facilities by governments. To address the need for testing in urban areas for those without vehicles, CannonDesign architect Albert Rhee created a walk-in testing booth that is slated for public use. Keeping medical professionals healthy during the COVID-19 pandemic is essential in both slowing the rate of infection and meeting heightened staffing needs. Many governments and healthcare providers are finding this to be a difficult task due to the global shortage of personal protective equipment (PPE) supplies. A walk-in testing booth provides an alternative solution that eliminates physical provider-patient exposure in a modular format that is simple to deploy for temporary testing operations. The design is based on testing operations already in place at Yang Ji General Hospital in Seoul, South Korea (featured in this YouTube video). Similar solutions have emerged throughout the world, but design development and production seem to be limited to single-user, single-site applications.

In addition to the increase in production of PPE and flu fighting supplements and medication, there is an increasing trend of building remote testing facilities by governments. To address the need for testing in urban areas for those without vehicles, CannonDesign architect Albert Rhee created a walk-in testing booth that is slated for public use. Keeping medical professionals healthy during the COVID-19 pandemic is essential in both slowing the rate of infection and meeting heightened staffing needs. Many governments and healthcare providers are finding this to be a difficult task due to the global shortage of personal protective equipment (PPE) supplies. A walk-in testing booth provides an alternative solution that eliminates physical provider-patient exposure in a modular format that is simple to deploy for temporary testing operations. The design is based on testing operations already in place at Yang Ji General Hospital in Seoul, South Korea (featured in this YouTube video). Similar solutions have emerged throughout the world, but design development and production seem to be limited to single-user, single-site applications.

The Covid-19 pandemic has also pushed some companies to launch new products catering to the fear amongst consumers. Paint manufacturer Caparol has announced a new interior paint product with anti-microbial properties that that it says uses silver ions to bind and destroy the cell membrane of biological contaminants, including bacteria and viruses. Caparol Arabia, the UAE arm of the German paints multinational, claims its ‘CapaCare Protect’ is “an innovative and sustainable solution that provides better protection against harmful micro-organisms”. The new solution, which contains the company’s patented and advanced ‘SILVERbac’ technology, is said to secure walls and surfaces from bio-harm. Since the outbreak of Covid-19, Caparol Arabia says it has launched further testing to check its antimicrobial paint effectiveness at reducing the spread. However, the antibacterial, antifungal and antiviral properties of silver ions and silver compounds have been extensively studied for years.

The Covid-19 pandemic has also pushed some companies to launch new products catering to the fear amongst consumers. Paint manufacturer Caparol has announced a new interior paint product with anti-microbial properties that that it says uses silver ions to bind and destroy the cell membrane of biological contaminants, including bacteria and viruses. Caparol Arabia, the UAE arm of the German paints multinational, claims its ‘CapaCare Protect’ is “an innovative and sustainable solution that provides better protection against harmful micro-organisms”. The new solution, which contains the company’s patented and advanced ‘SILVERbac’ technology, is said to secure walls and surfaces from bio-harm. Since the outbreak of Covid-19, Caparol Arabia says it has launched further testing to check its antimicrobial paint effectiveness at reducing the spread. However, the antibacterial, antifungal and antiviral properties of silver ions and silver compounds have been extensively studied for years.

End.

Sources:

https://www.cbnme.com/logistics-news/rta-dubai-to-offer-free-bus-rides-and-50-discount-on-taxi-rides/

https://constructionexec.com/article/how-contractors-can-protect-themselves-employees-and-clients-amid-covid-19

https://www.khl.com/demolition-and-recycling-international/european-construction-urgent-measures-required-during-covid 9/143142.article?utm_source=newsletter&utm_medium=email&utm_campaign=Construction+and+Coronavirus+-+30th+March+2020&utm_term=C%26C

https://www.khaleejtimes.com/coronavirus-pandemic/coronavirus-impact-in-uae-what-construction-companies-in-dubai-are-doing-amid-outbreak-

https://meconstructionnews.com/40346/caparol-launches-new-interior-paint-with-anti-microbial-properties

https://www.cbnme.com/logistics-news/rta-dubai-to-offer-free-bus-rides-and-50-discount-on-taxi-rides/

https://www.cbnme.com/news/raq-contracting-outline-measures-taken-to-combat-covid-19/

https://www.cbnme.com/expert-insight/a-ceo-plan-for-coronavirus-actions-to-take-now/

https://gulfnews.com/uae/now-open-mobile-drive-thru-covid-19-test-centre-in-the-uae-1.1585412269525

https://www.cbnme.com/machinery/terex-to-ensure-smooth-operation-for-their-customers-despite-obstacles-posed-by-coronavirus/

https://www.cbnme.com/logistics-news/e-commerce-demand-rises-in-saudi-arabia-due-to-covid-19-oxford-business-group/

https://www.cbnme.com/news/cannondesign-creates-a-walk-in-testing-booth-for-covid-19-in-the-united-states/

https://constructionexec.com/article/how-contractors-can-protect-themselves-employees-and-clients-amid-covid-19

https://www.khaleejtimes.com/coronavirus-pandemic/combating-covid-19-video-app-zoom-rockets-to-fame-with-some-hiccups-amid-pandemic

Mingardi, continued that in particular, infrastructure investments should be directed towards 5G telecommunications, artificial intelligence, ’industrial Internet’, smart cities, education and health care. Di Primio’s Palazzani XTJ52C in Abruzzo model has an outreach of 19.5m, which is being increasingly required in Italy. The main applications are for the installation of 5G masts. The model’s Can Bus system automatically controls movements, leading to time and fuel savings of more than 20%, said the company.

Mingardi, continued that in particular, infrastructure investments should be directed towards 5G telecommunications, artificial intelligence, ’industrial Internet’, smart cities, education and health care. Di Primio’s Palazzani XTJ52C in Abruzzo model has an outreach of 19.5m, which is being increasingly required in Italy. The main applications are for the installation of 5G masts. The model’s Can Bus system automatically controls movements, leading to time and fuel savings of more than 20%, said the company.

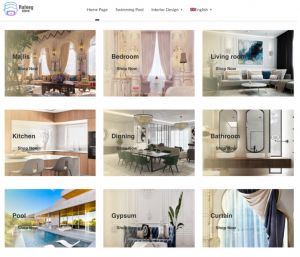

New emerging opportunities are increasing in the construction industry with some start ups capitalizing on the need to be online. An example of that is the MENA region’s first electronic store: Rafeeg Store. Rafeeg App founder, Mr.Khamis Al-Sheryani opened this store that specialises in construction, maintenance and decoration projects in the UAE. Through Rafeeg Store, customers can browse the designs of the best international engineers and decorations. They can also easily compare the rates of local contractors who are willing to design their homes. This opening aligns perfectly with the UAE government’s vision to follow through the best environmental practices in various fields, including contracting, maintenance, and design. The online store is now expanding its services in cooperation with a series of trusted international brands to help the market more sustainably in light of the new coronavirus outbreak.

New emerging opportunities are increasing in the construction industry with some start ups capitalizing on the need to be online. An example of that is the MENA region’s first electronic store: Rafeeg Store. Rafeeg App founder, Mr.Khamis Al-Sheryani opened this store that specialises in construction, maintenance and decoration projects in the UAE. Through Rafeeg Store, customers can browse the designs of the best international engineers and decorations. They can also easily compare the rates of local contractors who are willing to design their homes. This opening aligns perfectly with the UAE government’s vision to follow through the best environmental practices in various fields, including contracting, maintenance, and design. The online store is now expanding its services in cooperation with a series of trusted international brands to help the market more sustainably in light of the new coronavirus outbreak.

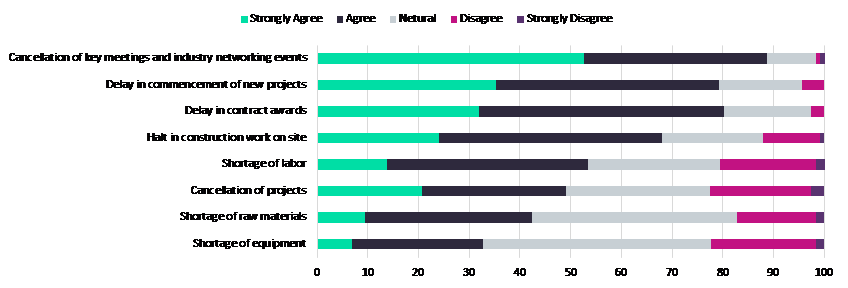

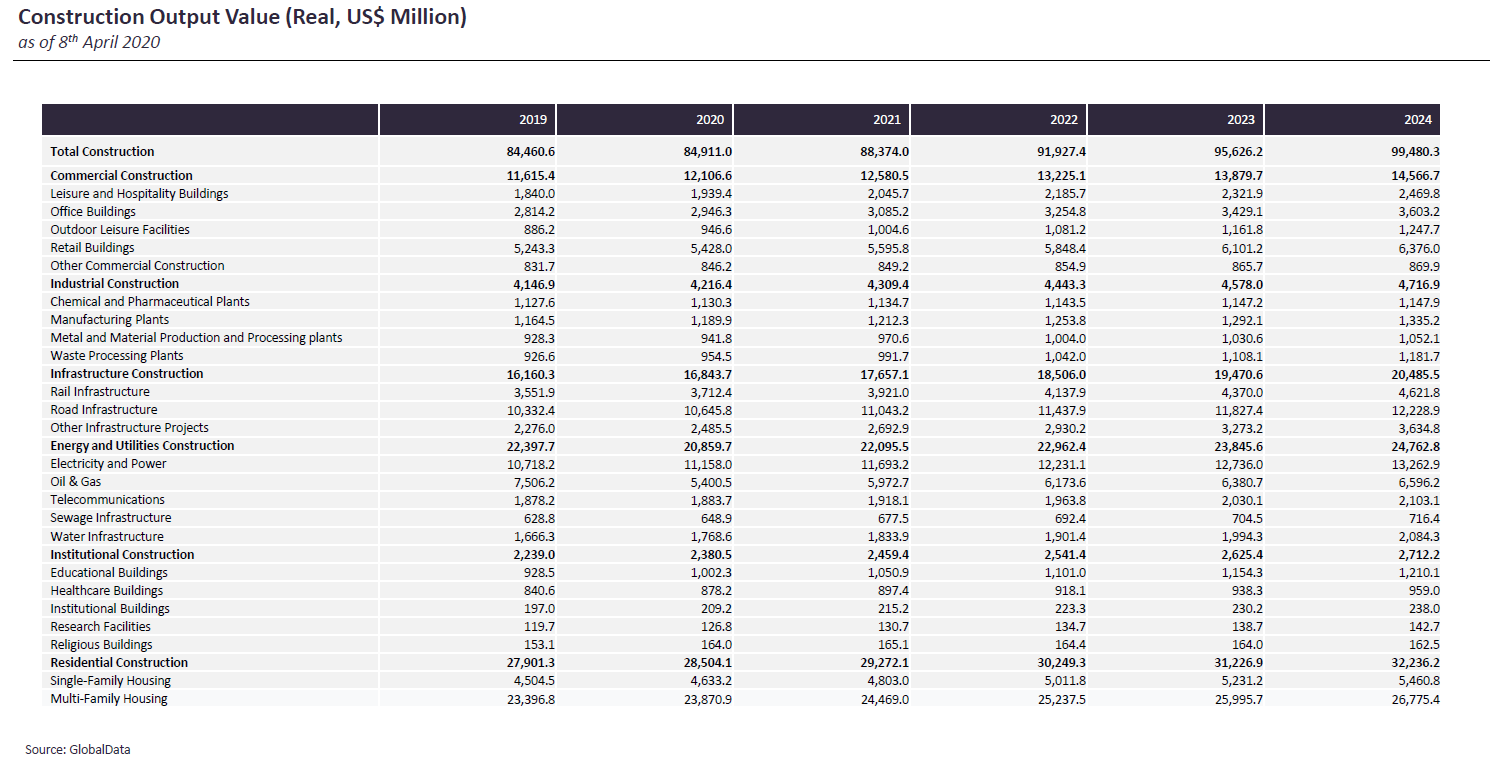

The main challenge for the industry in the short term is that projects that are under construction are being delayed, resulting in a range of legal and financial ramifications for contractors. The risk of project cancellations is also high. The survey shows that 49% of respondents agreed or strongly agreed that COVID-19 had resulted in project cancellations, whereas 78% agreed or strongly agreed that contract awards were being delayed as a result of the outbreak and its impact on investor confidence and general operations.

The main challenge for the industry in the short term is that projects that are under construction are being delayed, resulting in a range of legal and financial ramifications for contractors. The risk of project cancellations is also high. The survey shows that 49% of respondents agreed or strongly agreed that COVID-19 had resulted in project cancellations, whereas 78% agreed or strongly agreed that contract awards were being delayed as a result of the outbreak and its impact on investor confidence and general operations.

Supplier Case Study: The example of NFT

Supplier Case Study: The example of NFT  First step in facing any hazard is to conduct risk assessments and act according to the scientific recommendations to tackle the hazards. Our response covered several aspects to insure safety of our employees as our prime concern, and continuation of flow or work as long as the construction sector is still active in the UAE. We adjusted our modus operandi and adopted several work procedures according to International Recommendations and mitigation measures mandated by the UAE Government. Our updates, guidelines and recommendations come from trusted sources who are experts in the field, such as Department of Health in the UAE, World Health Organization (WHO), or Centers for Disease Control and Prevention (CDC).

First step in facing any hazard is to conduct risk assessments and act according to the scientific recommendations to tackle the hazards. Our response covered several aspects to insure safety of our employees as our prime concern, and continuation of flow or work as long as the construction sector is still active in the UAE. We adjusted our modus operandi and adopted several work procedures according to International Recommendations and mitigation measures mandated by the UAE Government. Our updates, guidelines and recommendations come from trusted sources who are experts in the field, such as Department of Health in the UAE, World Health Organization (WHO), or Centers for Disease Control and Prevention (CDC). From the very early stages, we set up Crises Management Committee formed from out top management, QHSE, Administration, Operations, and HR departments. The job of this committee is to follow up on the current situation, development of COVID-19, contact with UAE officials, contact with our sister companies overseas, and come up with measures in line with the official recommendations. NFT conducted more than 15 dissemination and awareness sessions about the virus and methods to control its spread to different groups in multilanguages. We made sure that the sessions we tailored to each group to reach all our employees and each in their vocation. Special attention sessions and trainings were conducted with sanitation people, drivers, or the more vulnerable groups who can be more exposed as per our risk assessment surveys. In addition, flyers, posters, videos, and publications were circulated wherever possible inside the offices, workshop, vehicles, and even labor camps dormitories.

From the very early stages, we set up Crises Management Committee formed from out top management, QHSE, Administration, Operations, and HR departments. The job of this committee is to follow up on the current situation, development of COVID-19, contact with UAE officials, contact with our sister companies overseas, and come up with measures in line with the official recommendations. NFT conducted more than 15 dissemination and awareness sessions about the virus and methods to control its spread to different groups in multilanguages. We made sure that the sessions we tailored to each group to reach all our employees and each in their vocation. Special attention sessions and trainings were conducted with sanitation people, drivers, or the more vulnerable groups who can be more exposed as per our risk assessment surveys. In addition, flyers, posters, videos, and publications were circulated wherever possible inside the offices, workshop, vehicles, and even labor camps dormitories. Highest risks and challenges occur while commuting to work or living in labor camps that have high concentration of people. With the extraordinary efforts of the health authorities in the UAE, we managed to screen all our working force and implement extra precautions in collaboration of labor camps management. Commuting to work according to the UAE authorities directives, follows 30% occupancy in the vehicles. Effectively it means, we tripled our busses to labor camps, we increased our fleet/trips of small vehicles and minibuses. In addition, we added separate plastic sheet inside the busses in order to separate the driver from the passengers. Deep disinfection is carried out for the whole yard periodically and upon need. On the other hand, all teams were divided into segregated

Highest risks and challenges occur while commuting to work or living in labor camps that have high concentration of people. With the extraordinary efforts of the health authorities in the UAE, we managed to screen all our working force and implement extra precautions in collaboration of labor camps management. Commuting to work according to the UAE authorities directives, follows 30% occupancy in the vehicles. Effectively it means, we tripled our busses to labor camps, we increased our fleet/trips of small vehicles and minibuses. In addition, we added separate plastic sheet inside the busses in order to separate the driver from the passengers. Deep disinfection is carried out for the whole yard periodically and upon need. On the other hand, all teams were divided into segregated  groups that work in isolation from each other. In case any symptoms appear on any of the team members, the one with symptoms would go for check up, while the others in the same team would be sent to self-isolation until further verification of the health conditions. Meanwhile, the job would be carried out with another group, hence keeping work flow uninterrupted.

groups that work in isolation from each other. In case any symptoms appear on any of the team members, the one with symptoms would go for check up, while the others in the same team would be sent to self-isolation until further verification of the health conditions. Meanwhile, the job would be carried out with another group, hence keeping work flow uninterrupted. In parallel, the same measures were conducted to maintain social distancing in the office, when possible the employees could carry out their jobs without the need to come to office. In case coming to office is essential, we restructured the office distribution as to maintain necessary social distancing as recommended. An infrared gun thermometer was placed at the reception for all those entering to voluntarily check their temperatures. A special team is deployed for disinfecting all surfaces, office appliances, door knobs, handles, restroom facilities, round the clock during working hours. Paper circulation was reduced to minimum, and when necessary special disinfected plastic files were used to carry the papers.Masks and gloves are distributed in different types and frequency according to the risk analysis.Special awareness sessions and measures are put in place for the more Vulnerable people (by virtue of their age, underlying health condition, clinical condition or are expecting). They follow the highest strict precautions.Fingerprinting for sign in/out were temporarily deactivated and replaced with photo/ web sign in/out.Provided additional handwashing facilities with soap, and if not available hand sanitizing solutions, especially in vehicles, and at building hallways, entrances, and exits.We increased rubbish bins number and rubbish collection, and spread them in order to reduce any remaining.We reduced site meetings to absolute necessary ones whether external meeting or internal. When possible, we use virtual meetings using technology as Microsoftteams.

In parallel, the same measures were conducted to maintain social distancing in the office, when possible the employees could carry out their jobs without the need to come to office. In case coming to office is essential, we restructured the office distribution as to maintain necessary social distancing as recommended. An infrared gun thermometer was placed at the reception for all those entering to voluntarily check their temperatures. A special team is deployed for disinfecting all surfaces, office appliances, door knobs, handles, restroom facilities, round the clock during working hours. Paper circulation was reduced to minimum, and when necessary special disinfected plastic files were used to carry the papers.Masks and gloves are distributed in different types and frequency according to the risk analysis.Special awareness sessions and measures are put in place for the more Vulnerable people (by virtue of their age, underlying health condition, clinical condition or are expecting). They follow the highest strict precautions.Fingerprinting for sign in/out were temporarily deactivated and replaced with photo/ web sign in/out.Provided additional handwashing facilities with soap, and if not available hand sanitizing solutions, especially in vehicles, and at building hallways, entrances, and exits.We increased rubbish bins number and rubbish collection, and spread them in order to reduce any remaining.We reduced site meetings to absolute necessary ones whether external meeting or internal. When possible, we use virtual meetings using technology as Microsoftteams. Manufacturer Case Study: The example of Terex

Manufacturer Case Study: The example of Terex  The surge of video conferencing is remarkable. An example is the Zoom, who despite scrutiny over security issues, has seen its market value skyrocket to some $35 billion. As people around the world stay home due to coronavirus risk, Zoom has become a go-to service for remote education, exercise classes, games, church services and happy hour celebrations. Couples have gotten married in “zoomed” ceremonies. Birthdays have been celebrated. Funerals have been virtually attended.

The surge of video conferencing is remarkable. An example is the Zoom, who despite scrutiny over security issues, has seen its market value skyrocket to some $35 billion. As people around the world stay home due to coronavirus risk, Zoom has become a go-to service for remote education, exercise classes, games, church services and happy hour celebrations. Couples have gotten married in “zoomed” ceremonies. Birthdays have been celebrated. Funerals have been virtually attended. In addition to the increase in production of PPE and flu fighting supplements and medication, there is an increasing trend of building remote testing facilities by governments. To address the need for testing in urban areas for those without vehicles, CannonDesign architect Albert Rhee created a walk-in testing booth that is slated for public use. Keeping medical professionals healthy during the COVID-19 pandemic is essential in both slowing the rate of infection and meeting heightened staffing needs. Many governments and healthcare providers are finding this to be a difficult task due to the global shortage of personal protective equipment (PPE) supplies. A walk-in testing booth provides an alternative solution that eliminates physical provider-patient exposure in a modular format that is simple to deploy for temporary testing operations. The design is based on testing operations already in place at Yang Ji General Hospital in Seoul, South Korea (featured in this YouTube video). Similar solutions have emerged throughout the world, but design development and production seem to be limited to single-user, single-site applications.

In addition to the increase in production of PPE and flu fighting supplements and medication, there is an increasing trend of building remote testing facilities by governments. To address the need for testing in urban areas for those without vehicles, CannonDesign architect Albert Rhee created a walk-in testing booth that is slated for public use. Keeping medical professionals healthy during the COVID-19 pandemic is essential in both slowing the rate of infection and meeting heightened staffing needs. Many governments and healthcare providers are finding this to be a difficult task due to the global shortage of personal protective equipment (PPE) supplies. A walk-in testing booth provides an alternative solution that eliminates physical provider-patient exposure in a modular format that is simple to deploy for temporary testing operations. The design is based on testing operations already in place at Yang Ji General Hospital in Seoul, South Korea (featured in this YouTube video). Similar solutions have emerged throughout the world, but design development and production seem to be limited to single-user, single-site applications. The Covid-19 pandemic has also pushed some companies to launch new products catering to the fear amongst consumers. Paint manufacturer Caparol has announced a new interior paint product with anti-microbial properties that that it says uses silver ions to bind and destroy the cell membrane of biological contaminants, including bacteria and viruses. Caparol Arabia, the UAE arm of the German paints multinational, claims its ‘CapaCare Protect’ is “an innovative and sustainable solution that provides better protection against harmful micro-organisms”. The new solution, which contains the company’s patented and advanced ‘SILVERbac’ technology, is said to secure walls and surfaces from bio-harm. Since the outbreak of Covid-19, Caparol Arabia says it has launched further testing to check its antimicrobial paint effectiveness at reducing the spread. However, the antibacterial, antifungal and antiviral properties of silver ions and silver compounds have been extensively studied for years.

The Covid-19 pandemic has also pushed some companies to launch new products catering to the fear amongst consumers. Paint manufacturer Caparol has announced a new interior paint product with anti-microbial properties that that it says uses silver ions to bind and destroy the cell membrane of biological contaminants, including bacteria and viruses. Caparol Arabia, the UAE arm of the German paints multinational, claims its ‘CapaCare Protect’ is “an innovative and sustainable solution that provides better protection against harmful micro-organisms”. The new solution, which contains the company’s patented and advanced ‘SILVERbac’ technology, is said to secure walls and surfaces from bio-harm. Since the outbreak of Covid-19, Caparol Arabia says it has launched further testing to check its antimicrobial paint effectiveness at reducing the spread. However, the antibacterial, antifungal and antiviral properties of silver ions and silver compounds have been extensively studied for years.

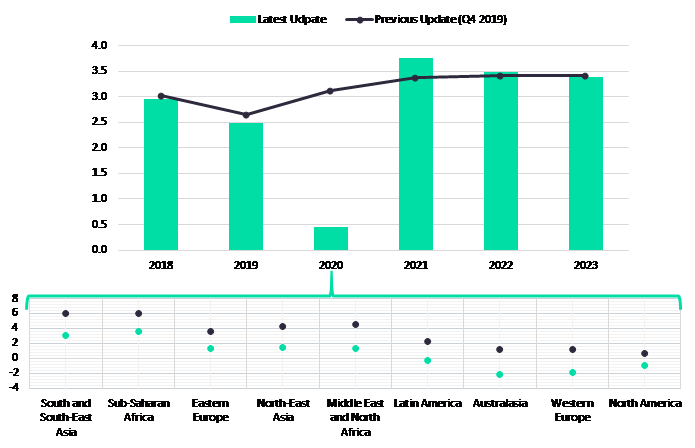

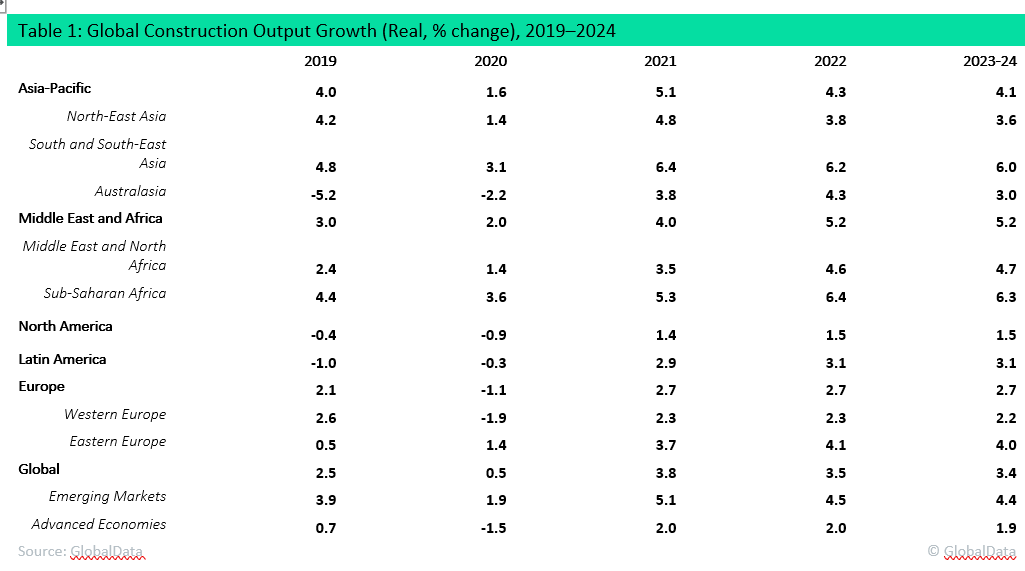

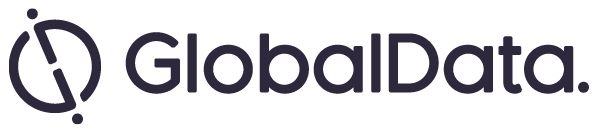

Given the severe disruption in China and other leading economies worldwide following the COVID-19 outbreak, GlobalData’s forecast for construction output growth in 2020 has been revised down to 0.5%, compared to the previous forecast of 3.1% growth (in the Q4 2019 update).

Given the severe disruption in China and other leading economies worldwide following the COVID-19 outbreak, GlobalData’s forecast for construction output growth in 2020 has been revised down to 0.5%, compared to the previous forecast of 3.1% growth (in the Q4 2019 update). This package is intended to support banks and businesses during the Coronavirus crisis for up to six months. Experts in the field say this package will be beneficial for the local construction sector, which includes small and medium-sized design and contracting enterprises. The UAE government has managed to suspend social activities without a severe effect on economic output. In the construction sector, remote working, which some private sector employers in the UAE have voluntarily offered, could impact administrative procedures that are essential for site works to progress, such as sign-offs and schedule management. Meanwhile, even though cargo travel currently faces fewer restrictions than passenger flights, supply chain disruptions are likely to deepen in the weeks ahead. China – the world’s largest exporter and the epicentre of COVID-19 – has only just begun a slow recovery after its factories were shut down for almost two months to curb the spread of the virus.

This package is intended to support banks and businesses during the Coronavirus crisis for up to six months. Experts in the field say this package will be beneficial for the local construction sector, which includes small and medium-sized design and contracting enterprises. The UAE government has managed to suspend social activities without a severe effect on economic output. In the construction sector, remote working, which some private sector employers in the UAE have voluntarily offered, could impact administrative procedures that are essential for site works to progress, such as sign-offs and schedule management. Meanwhile, even though cargo travel currently faces fewer restrictions than passenger flights, supply chain disruptions are likely to deepen in the weeks ahead. China – the world’s largest exporter and the epicentre of COVID-19 – has only just begun a slow recovery after its factories were shut down for almost two months to curb the spread of the virus. It is anticipated that the timeline will be at least 10 months away, meaning that hygienic and exposure-control measures will continue to be the first line of defense for most governments. In many countries around the world, hospitals or care facilities are emerging over night as the number of infected cases increased.

It is anticipated that the timeline will be at least 10 months away, meaning that hygienic and exposure-control measures will continue to be the first line of defense for most governments. In many countries around the world, hospitals or care facilities are emerging over night as the number of infected cases increased.

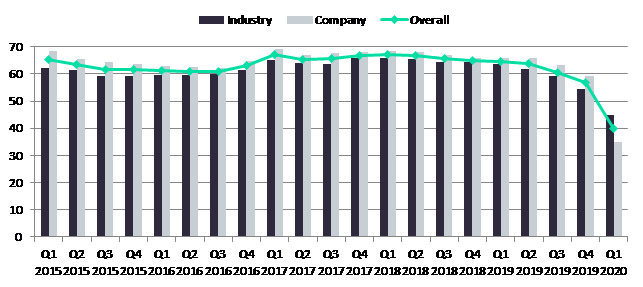

The tallest crane in the world reaches a height of 250 meters, carries more than 3000 tons, and is called ‘Big Carl’ (feature image).The Big Carl was designed by a Belgian crane rental service and was carried to Somerset, UK, on over 250 trucks for months. Big Carl is being used to build the first nuclear power plant in the UK in 30 years. In terms of tower cranes, The KROLL K-10000 has held the title of one of the world’s largest tower crane for over 40 years. Standing almost 400 feet tall with a 266 foot jib reach, the standard jib model can lift 120 tons at a radius of 269 feet. The long jib model can lift 94 tons to a radius of 330 ft. The K-10000 can rotate 360° once it has been bolted to its 40 foot diameter concrete base. This allows the crane to cover an area of 7.5 acres, or approximately 6 football fields. A second servicing crane is attached to the top for the original construction and future maintenance of the K-10000. A system of three counterweights, one set and two mobile on trolleys, weighing a total of 100 tons, are used to balance the crane. Under this load the crane can withstand wind speeds of up to 175 mph. With its immense jib span and load capacity the K-10000 decreases the time for construction on huge construction projects by eliminating the need for small cranes and crawlers.

The tallest crane in the world reaches a height of 250 meters, carries more than 3000 tons, and is called ‘Big Carl’ (feature image).The Big Carl was designed by a Belgian crane rental service and was carried to Somerset, UK, on over 250 trucks for months. Big Carl is being used to build the first nuclear power plant in the UK in 30 years. In terms of tower cranes, The KROLL K-10000 has held the title of one of the world’s largest tower crane for over 40 years. Standing almost 400 feet tall with a 266 foot jib reach, the standard jib model can lift 120 tons at a radius of 269 feet. The long jib model can lift 94 tons to a radius of 330 ft. The K-10000 can rotate 360° once it has been bolted to its 40 foot diameter concrete base. This allows the crane to cover an area of 7.5 acres, or approximately 6 football fields. A second servicing crane is attached to the top for the original construction and future maintenance of the K-10000. A system of three counterweights, one set and two mobile on trolleys, weighing a total of 100 tons, are used to balance the crane. Under this load the crane can withstand wind speeds of up to 175 mph. With its immense jib span and load capacity the K-10000 decreases the time for construction on huge construction projects by eliminating the need for small cranes and crawlers.

Construction on Saudi’s $500bn (SAR1.9tn) Neom gigaproject will start in Q1 2019, officials announced on 16 January, 2019.

Construction on Saudi’s $500bn (SAR1.9tn) Neom gigaproject will start in Q1 2019, officials announced on 16 January, 2019. HH Sheikh Mohammed bin Rashid al Maktoum, the UAE Vice President, Prime Minister and Ruler of Dubai, has announced the launch of a massive plan that will see more than 34,000 residential units built across the country within the next six years.

HH Sheikh Mohammed bin Rashid al Maktoum, the UAE Vice President, Prime Minister and Ruler of Dubai, has announced the launch of a massive plan that will see more than 34,000 residential units built across the country within the next six years. Manitowoc, one of the leading global manufacturers of cranes and lifting solutions, has announced the debut of six new models from its Grove and Potain lines at bauma 2019 in Munich, Germany. T he company will also present a technology pavilion, highlighting a wide range of customer-focused innovations. Apart from the six new cranes, Manitowoc will display more than 10 new cranes during the show from 8-14 April 2019.

Manitowoc, one of the leading global manufacturers of cranes and lifting solutions, has announced the debut of six new models from its Grove and Potain lines at bauma 2019 in Munich, Germany. T he company will also present a technology pavilion, highlighting a wide range of customer-focused innovations. Apart from the six new cranes, Manitowoc will display more than 10 new cranes during the show from 8-14 April 2019.

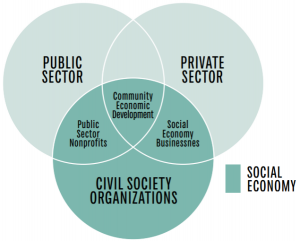

Ministry of finance of the republic of Lithuania has summarized the advantages and some of the disadvantages of PPP, which are as following:

Ministry of finance of the republic of Lithuania has summarized the advantages and some of the disadvantages of PPP, which are as following: According to the UAE government website, “in 2017, the UAE Cabinet issued resolution (1/1) on the procedures manual for partnership between federal entities and private sector. The manual intends to diversify the mechanisms for developing the strategic infrastructure projects and improve the quality of services. It also provides a general framework for project lifecycle of partnerships with private sectors.

According to the UAE government website, “in 2017, the UAE Cabinet issued resolution (1/1) on the procedures manual for partnership between federal entities and private sector. The manual intends to diversify the mechanisms for developing the strategic infrastructure projects and improve the quality of services. It also provides a general framework for project lifecycle of partnerships with private sectors. According to an article published on ME Construction News website, while there has been collaboration between the public and private sectors for some time, the relationship has been restricted to service contracts and to the water, energy and transport sectors. Most projects in the GCC region developed using a recognised PPP model have traditionally done so under each market’s own version of tender and procurement laws.

According to an article published on ME Construction News website, while there has been collaboration between the public and private sectors for some time, the relationship has been restricted to service contracts and to the water, energy and transport sectors. Most projects in the GCC region developed using a recognised PPP model have traditionally done so under each market’s own version of tender and procurement laws. Oman will lay the foundation stone for an affordable housing development built through a public-private partnership (PPP) in the coastal city of Barka on 22 October. Representatives from the country’s Supreme Council of Planning (SCP) will attend the ground-breaking ceremony for the integrated residential project in northern Oman, on behalf of HE Sheikh Saif bin Mohammed Al Shabibi, Minister of Housing.

Oman will lay the foundation stone for an affordable housing development built through a public-private partnership (PPP) in the coastal city of Barka on 22 October. Representatives from the country’s Supreme Council of Planning (SCP) will attend the ground-breaking ceremony for the integrated residential project in northern Oman, on behalf of HE Sheikh Saif bin Mohammed Al Shabibi, Minister of Housing.