The global construction industry has been under intense stress in recent months amid the COVID-19 crisis and associated containments measures to prevent the continued spread of the virus. Even in countries where the construction industry has been permitted to continue, being exempt from restrictions on general business activity, there has still been widespread disruption and temporary shutdowns of construction sites. Reflecting the severe impact on the industry, provisional data for some major markets in Europe reveal that construction output plummeted in April during the peak of the pandemic in the region, with Italy recording a 68% year-on-year drop, and France a 60% decline. Such unprecedented declines are expected in other markets that have seen construction work grind to a halt.

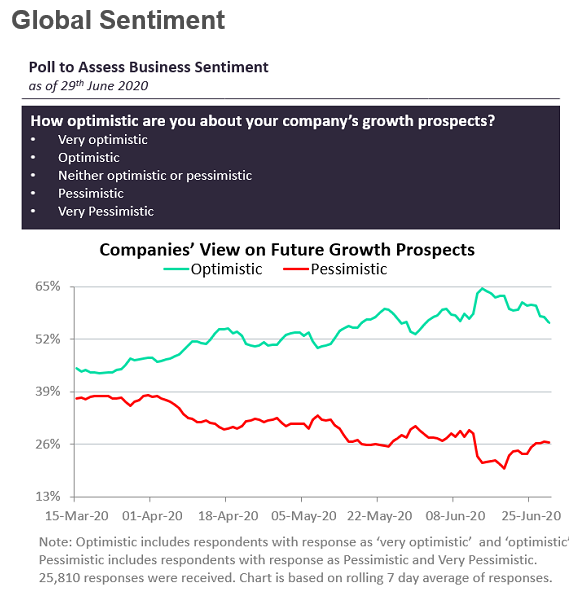

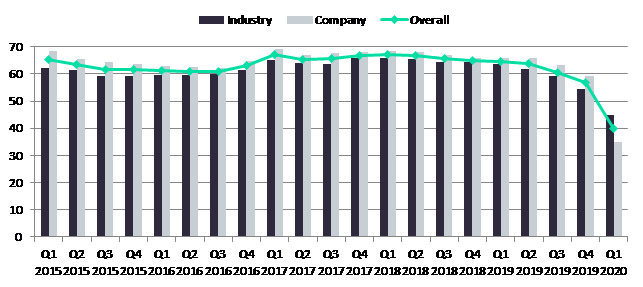

General Global Business Sentiment according to GlobalData

The Plight of Construction and Real Estate Industries

The construction and real estate industries are certainly not exempted from the global and regional economic disruptions. Due to existing inventory levels, short term impacts on ongoing construction activities have been minimal. With threats to employment and economic growth, there is deteriorating confidence in investments which can leave adverse effects in the long term.

Experts point out how China and Italy largely contribute to the hospitality, residential, and commercial projects in terms of supplying luxury interior materials. However, as businesses rethink their procurement strategies due to changing consumer trends, there will be an inevitable slowdown in factory operations and a larger focus to source locally. To add to that, countries such as India have closed a large number of steel plants. There will be a global surge in demand when these factories open for normal functioning. This will most likely add pressure to these industries and therefore, leading to long term impacts.

The question at hand remains, are all long-term ramifications on the regional construction and real estate industry at a disadvantage?

Concerning the real estate demand in the UAE, it is safe to say it is a valued and robust industry. It offers excellent value across select developments. Investors will be able to take advantage of projects by offering discounted prices, leaseback options, and other incentives during this time. The Abu Dhabi government has also waived off real estate registration fee of 2%. This might increase transaction activity as residents currently renting will find it more affordable and lucrative to purchase their property.

Post COVID-19 Strategies for Real Estate Projects

As the world adjusts the new normal, some strategies will shape the real estate industry post-COVID-19. New methods such as integrating improved artificial intelligence and carefully analyzing infrastructure qualities will help this industry grow.

Although industries have taken a massive hit from the monetary downfalls due to economic standstills, certain government’s efforts are starting to pay off as several

Post COVID-19 Strategies for Real Estate Projects

As the world adjusts the new normal, some strategies will shape the real estate industry post-COVID-19. New methods such as integrating improved artificial intelligence and carefully analyzing infrastructure qualities will help this industry grow. Although industries have taken a massive hit from the monetary downfalls due to economic standstills, certain government’s efforts are starting to pay off as several industries are now on a path to fast-track recovery. The real estate industry, in particular, is heading towards a new direction in terms of market demand.

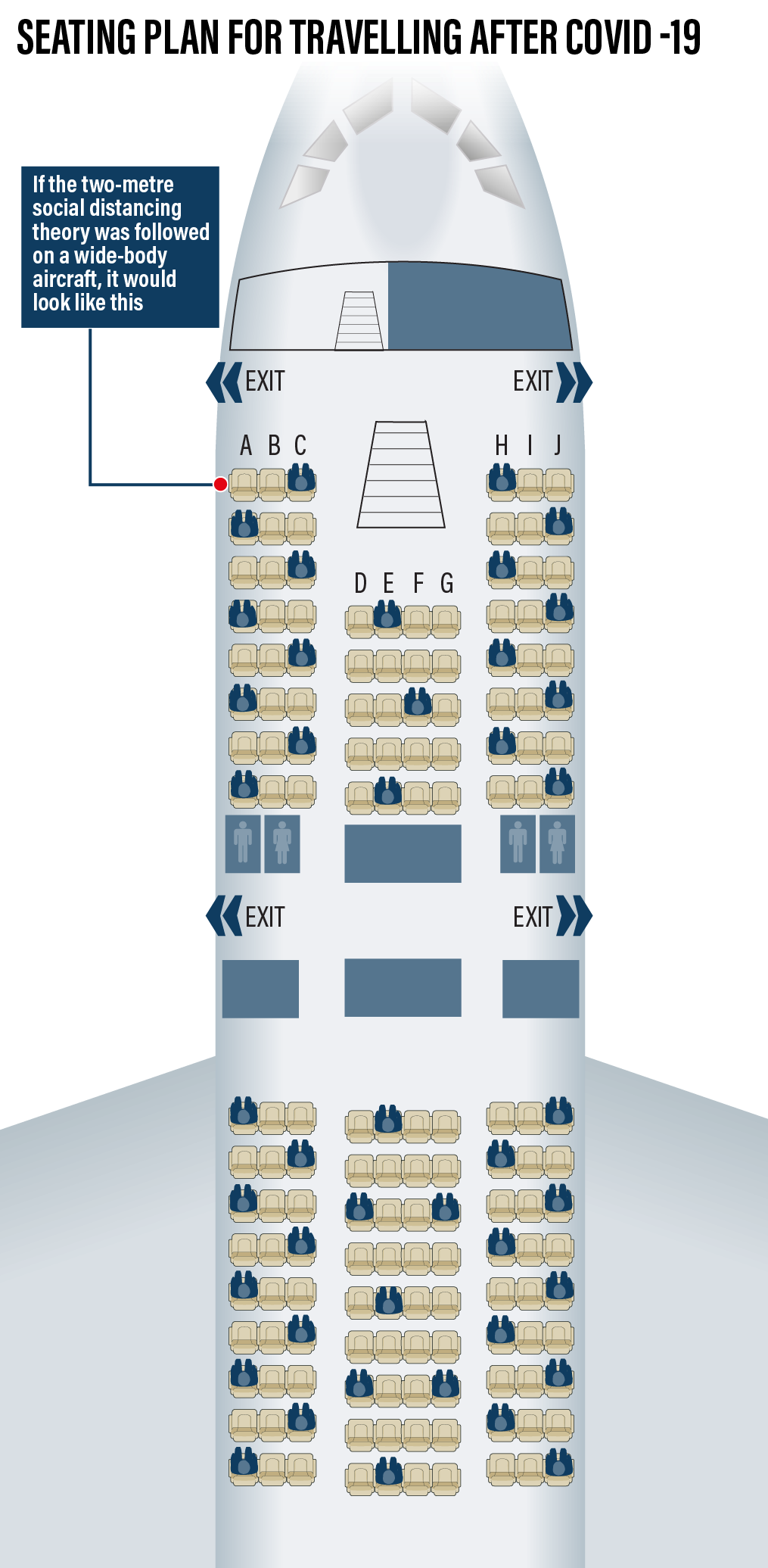

- Post COVID-19 periods will also see a rise in demand for lower-density properties and locations. Rethinking design to maintain social distancing standards will become top priorities for developers.

- Building layouts will see major revamping by the allocation of extra spaces and designs that adhere to safety aspects to add value.

- In addition to new design standards, builders also need to focus on the quality of infrastructure. Industry leaders need to commit to high-grade materials and carefully assess conditions that will stand out to their stakeholders.

- An aspect that was becoming prominent much before the dawn of COVID-19 was the concept of artificial intelligence. With time it has gained traction and has enabled buyers to experience properties without physical visits. An example of this is Smart Investment Map (SIM) which the Real Estate Investment Management and Promotion Center, the investment arm of Dubai Land Department has launched to attract major investors for off-plan available projects. SIM is an online portal serving Dubai Real Estate Market; specially designed for real estate professionals to list their properties for sale and rent in Dubai. SIM provides public with a number of e-services allowing them to search for properties listed for sale or rent, communicate with property owners, brokers and management companies and complete sale transactions online without the need for multiple visits to Dubai Land Department. Another example is the DubaiNow application which offers access to over 85 city services that include bill payments, NOL, fuel top-ups, property finding and much more. This app has a rating of 3.7 on Apple iStore.

If companies and developers focus on following these strategies, both them and the industry will recover from the hit it has taken because of the COVID-19 crises within no time. As the new normal are here to stay, all industries need to start opting to the new normal planning strategies as well.

Zooming in on the Construction Industry

With economies crashing and projects coming to a halt amidst the COVID-19 lockdowns, let us take a closer look at the impact on the construction sector.

The outbreak and subsequent spread of COVID-19 has drastically changed the course of construction projects all around the world, including the Middle East. Different projects will experience delays, disruptions, and cost escalation.

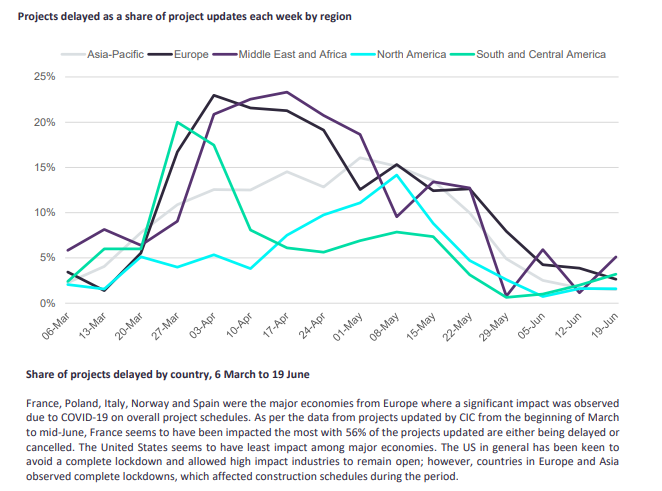

Construction Industry and in particular projects schedules have seen dramatic changes in last couple of months. From the beginning of March, the construction industry began to experience much higher levels of project delays and cancellations due to the COVID-19 pandemic, with widespread restrictions on the movement of people and enforcement of complete or partial lockdowns from mid-March. The impact during the month of April and beginning of May was at its peak with approximately 15-20% of projects were either cancelled or delayed; however, since mid-May the overall situation has improved. The share of delayed projects out of all projects updated fell to around 2% by mid-June. In the USA for example, the Associated General Contractors of America (AGC)’s latest survey found that nearly one fourth of contractors reported a project that was scheduled to start in June or later had been canceled.

Keeping in mind the brutal blow economies all across the globe are facing, measures had to be in place to ensure project delays did not inflict widespread damages. In the light of the dramatic fall in oil prices in the UAE, it is yet to be seen what economic effects we will be facing due to the novel coronavirus. The fall in the market may have repercussions on liquidity and cash flow throughout the construction sector. It is particularly prevalent in this region where ‘pay when paid’ clauses are permitted and often seen in subcontractors.

The smooth flow of funds in the construction sector is going to be taken up by banks, which will allow contractors and companies to dodge the constant problems of delayed payments. With banks being open to extending repayment terms, liquidity is less of an issue to contractors.

As a response to the current situations owing to the COVID-19 virus, banks in the UAE will ease construction sectors’ payment issues. UAE banks’ exposure to the construction industry is estimated at 15% plus. The UAE Central Bank is also required to be more lenient on payments due from clients. Banks have received orders to give more flexibility on loan paybacks, and any transactions clients have with the banks and easing pay for contractors become a top priority by banks.

As a response to the current situations owing to the COVID-19 virus, banks in the UAE will ease construction sectors’ payment issues. UAE banks’ exposure to the construction industry is estimated at 15% plus. The UAE Central Bank is also required to be more lenient on payments due from clients. Banks have received orders to give more flexibility on loan paybacks, and any transactions clients have with the banks and easing pay for contractors become a top priority by banks.

With many industries being vulnerable to the impacts of the virus outbreaks, construction projects are some of the most vulnerable sectors. The UAE has about $710 billion of building and civil engineering projects currently planned or underway. There would be revisions once the full impact of the COVID-19 impact is understood. All the issues of the construction industry have been brought forward with the pandemic. We need to be thoughtful about the problems every sector is facing. The mobility of labour is not the only hindrance. Delays in exporting or importing goods, materials, plants, and equipment owing to travel bans and lockdown may consequently impact the progress of construction projects everywhere. Delay in projects is bound to happen. There are no two ways to it. We need contracts that allow the smooth functioning of the industry without anyone getting into disputes. This is why banks need to step up and further ease their procedures as their plan of action during these trying times will be reflected deeply in future provisions.

Investment and Adaptability to Digital Transformation

The construction industry has evolved over the years in the way they design, plan, and build structures. Technology makes construction projects more efficient and safer. It also makes room for more innovation. Adopting artificial intelligence can help optimize work schedules, improve workplace safety, and keep a watch on facilities. From small scale projects to multi-year and large scale projects, machine learning is excelling at finding patterns in data. With the help of pattern recognition and historical data, artificial intelligence has time and again proven to help better manage schedules. It can help prevent costly delays amongst suppliers, vendors, and everyone involved in the process.

The same pattern detection deployed to schedule time can be used to look for common trends in projects. Many sites use artificial intelligence to run through contingency plans. The technology can assess what might happen if a permit is delayed or an accident occurs, forecast outcomes of multiple scenarios and even anticipate breakdown. This exercise can help develop contingency plans to tackle unexpected situations.

The use of autonomous devices, drones, and robotic construction workers is also on the rise. Drones help in surveying and taking overhead images of construction projects. Robots help with various mundane tasks such as bricklaying, concrete pouring, or installing drywall. Such devices help cut labour costs and keep the project on track with regards to time.

Advanced data intelligence also increases safety. Construction is not without hazards. Potential on-site risks such as dangerous structures and moving equipment that poses a danger to humans exist in every construction project. Artificial intelligence helps contain or completely eradicate the possibility of these hazards to occur. Sites are also equipped by cameras and sensors that monitor several aspects of construction operations. Advanced systems are capable of detecting unsafe behaviour and alerting teams of potential hazards. They not only reduce liability but can also help save lives and increase efficiency.

Surveillance systems are not new to workplace environments. Keeping an eye over the projects and sites is an added level of security. Investing in expensive equipment can help companies monitor footage and spot suspicious activities.

Enabling and adopting artificial intelligence has delivered incredible results and is being deployed by more and more construction companies with each passing day. Assessment of the results shows artificial intelligence can help in cost savings, time savings, and overall improvements in construction projects.

An example of a country that is putting digital transformation at the forefront of the construction industry is Australia where a collaboration between 30 partners including universities and the CRC (Australian government’s Cooperative Research Centres Program). The scheme, called Building 4.0 CRC, is focused on cutting delays, emissions and waste from building projects has received a grant of 28 million Australian dollars ($16.40 million) from the country’s government. The objectives include harnessing digital technology and off-site manufacturing to cut project costs by 30%; reducing construction waste by 80%; and lowering carbon dioxide emissions by 50%. “Our vision is to create a world where people can visualize and realize buildings in real time. The purpose is to transform the way that consumers and builders design and buy buildings by providing easy-to-use browsing-based software that allows them to custom-design, visualize and price buildings in an engineering compliant way,” said Gavin Tonn who is Australian CEO of the Donovan Group, said in a statement.

The Dubai Development Authority (DDA) has also taken a number of steps to mitigate the impact of COVID-19 on the construction sector. These have included:

- The announcement of a Planning and Development Stimulus Initiative.3Under this initiative: (i) the payment of Final Building Permit Fees are split into four instalments4; (ii) the payment dates of fines issued by the Planning and Development Department are postponed for three months; (iii) zoning exception fees are now payable within 12 months rather than six months; (iv) additional or modified built up area fees are now due within three months instead of one month; (v) the issuance of Conditional Completion Certificates (undertaking letter) will be free of charge for three months from the date of the initiative; and (v) the validity period for any Building Permit, Fit-out Permit, Temporary Construction Permit, or Permit to Work within a “right of way” will be extended by an additional three months without charge.

- The introduction of virtual inspections of construction sites.5 Sites can now be inspected at various stages of a project by way of either a Zoom or Microsoft Teams video call, without inspectors having to be physically present on site.

Investment needed for Health & Safety

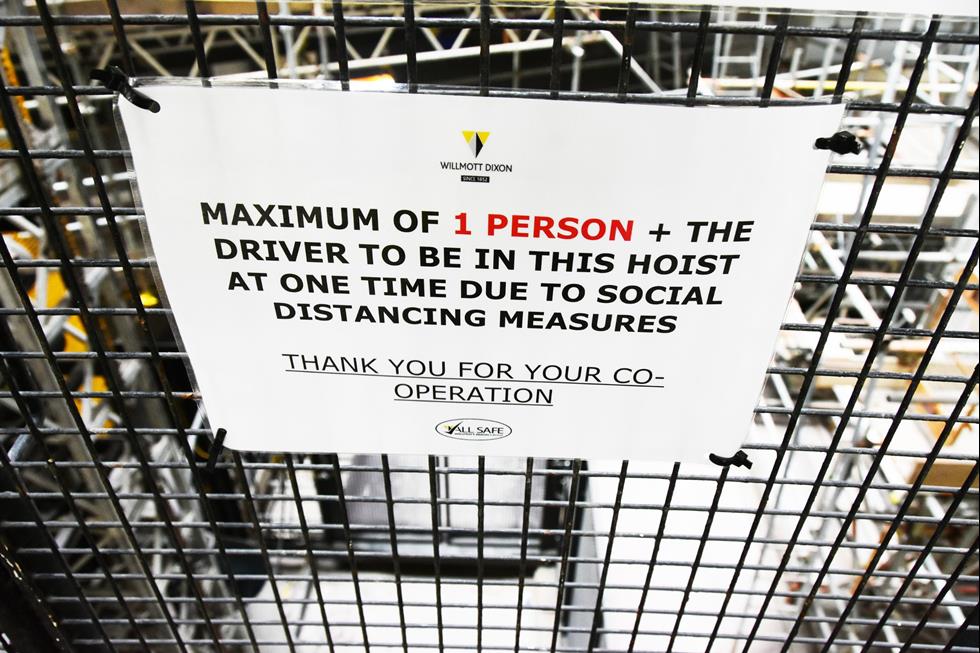

In most cases, lockdowns may have caused a delay in project completion, not complete shutdowns. Projects that continue their work at sites now have to take extra precautionary measures to ensure the safety of the workers.

Employers may need to review their health and safety policies and protocols and adhere to Government regulations in the context of COVID-19. Safety measures such as maintaining social distancing, sanitation, and providing protective equipment such as masks need to be kept in check by employers for those at the construction sites. Other measures, such as providing remote working facilities to office staff and improving the delivery of information about disease prevention on-site, have also been implemented.

Employers need to focus on medical screening to satisfy care and combating the spread of the virus at these stages. The Occupational Safety and Health Administration Department has updated its guidance to supplement the general terms to accommodate the interim guidance for all workers and employers of workers with potential occupational exposures to SARS-CoV-2. For complete review of the guidance for preparing workplaces for COVID-19, please read our blog: OSHAD & COVID-19.

Guidelines around Construction Workers

The demonstrations of precautionary actions such as restrictions imposed on travel bans in most regions are now posing a significant problem to the construction industry. On the one hand, companies are unable to get their migrant workers back due to these restrictions, therefore causing severe delays. On the other hand, we have the strict rules of self-isolation and quarantine that need to be followed to flatten the curve. Also, labor shortages are resulting in contractors having to pay workers on leave.

Specific guidelines have been issued by the municipality to ensure the health and safety of construction workers at projects sites amidst the COVID-19 virus outbreak.

The construction sector is one of those industries that has been identified as a vital industry and is exempted from strict movement restrictions in the UAE.

While ensuring normal operations, practicing on-site precautionary measures is crucial for all companies. It is for this reason that the Dubai Municipality’s Health and Safety Department has issued specific guidelines highlighting all the precautions to be adhered to by construction workers across the emirate which we anticipate will continue even post COVID-19 to avoid the spread and risk of infection:

In the UAE, the government announced that construction companies are now permitted to set up or construct labour accommodation on site. This will result in workers not being required to be transported to and from site and will assist in ensuring that social distancing precautions are maintained in existing labour accommodation. It is a requirement that on-site accommodations have enough space to ensure social distancing guidelines are adhered to.

Within Labor Accommodations: The precautionary measures to be followed by construction workers within labur accommodations include frequent disinfection and cleaning, limited gatherings, and social and physical distancing of 2 metres within specific areas. Body temperatures of workers must also be checked before entering and after exiting the premises. If a worker is found to have a high temperature, it is imperative that the worker is placed in isolation and checked for symptoms regularly. In Abu Dhabi, the Abu Dhabi’s Department of Health has undertaken a complete sanitation of industrial areas such as Musaffah and Al Ain Industrial area by testing all residents and isolating infected labors.

Within Labor Accommodations: The precautionary measures to be followed by construction workers within labur accommodations include frequent disinfection and cleaning, limited gatherings, and social and physical distancing of 2 metres within specific areas. Body temperatures of workers must also be checked before entering and after exiting the premises. If a worker is found to have a high temperature, it is imperative that the worker is placed in isolation and checked for symptoms regularly. In Abu Dhabi, the Abu Dhabi’s Department of Health has undertaken a complete sanitation of industrial areas such as Musaffah and Al Ain Industrial area by testing all residents and isolating infected labors.

All construction workers must practice safe physical distancing within buses. Sanitation must be of top priority, and large on-site gatherings must be avoided. Buses must also undergo frequent, and deep cleaning with government approved products.

The Impact of Changing Consumer Trends on other Industries

The impacts of the current lockdowns and restrictions have caused a significant effect on the functioning of majority industries. Disruptions in one sector have a ripple effect on other areas as well. As restrictions are easing in several places, businesses are planning a comeback into the physical working environment. However, there has been a fundamental shift in the way consumers are living, buying, and thinking amidst the COVID-19 pandemic. Even with restrictions lifting entirely or partially, going back to old behaviors and choices will take place over a long period.

Where the Consumer Preferences Lie

As consumers strive to adapt to new normals, they are also trying to contemplate what these changes will mean for themselves, their families, and society altogether. These concerns are both economic and health-related. Where priorities for hygienic and cleaning staples are increasing, non-essential goods are taking a slump.

These times call in for basic necessities of life taking precedence. There is no surprise that personal health is the top priority for the majority of consumers right now. Other industries like food, financial security and personal safety follow.

A study, based on Google Trends data, showed that searches in the online grocery shopping category reached a peak between March and May 2020 in the UAE. There was a 316% growth in online card payments for this sector in April. Distance learning was another sector that dominated the online search industry. The same study uncovered the surge in online searches for courses online as residents looked to improve their skills and knowledge, making the most of the lockdowns.

A study, based on Google Trends data, showed that searches in the online grocery shopping category reached a peak between March and May 2020 in the UAE. There was a 316% growth in online card payments for this sector in April. Distance learning was another sector that dominated the online search industry. The same study uncovered the surge in online searches for courses online as residents looked to improve their skills and knowledge, making the most of the lockdowns.

Lockdowns and remote working protocols also resulted in a sudden interest in telecommuting. The number of searches for “work from home in Dubai” surged before gradually declining once users became more familiar with remote working processes and tools. The shift to flexible working is one of the main factors driving a higher frequency of online searches for furniture as a need for home office workspaces emerged among residents.

Commuting and travelling

The Abu Dhabi Airport is one infrastructure which has demonstrated how technology can help transform safety measures. Be it touchless sensors, voice-activated technologies, or hands-free switches; every business needs to invest in digital transformation to gain the trust of its stakeholders.

Looking at Abu Dhabi International Airport as an example where many additional safety measures have been put in place to ensure the health and safety of passengers and staff:

- Introduction of strict social distancing rules between passengers and staff and the mandatory use of face masks and gloves

- Airport internal staff have been trained to monitor and ensure all additional health and safety rules are being followed by passengers

- With swab tests, rapid blood testing and temperature checks carried out on site, the airport has also employed external personnel to help man the testing stations each day, including 13 administration staff and nine nurses.

- 53 elevators located within the terminals have been upgraded with contact-less technology, meaning passengers do not have to touch any buttons when calling for a lift.

- Three vending machines containing medical protection kits, including face masks and gloves, have also been placed throughout the airport as well as more than 400 hand sanitizer stations.

- In total, 143 shield partitions have been placed on 71 check-in and immigration counters and several self-sanitizing hand rails have been positioned on escalators in the arrivals and departures terminals.

To conclude the situation of the construction and real estate industry, experts say that the proactive efforts of governments for these industries will ensure business continuity. These measures have also helped contain the damage of the pandemic on investors and agents. Companies and developers can combat losses as long as they start risk planning and implementing improved strategies and technologies. Even though governments are working relentlessly to flatten the curve and contain the spread of the virus, the effects of the pandemic will follow us in the coming months and some changes are here to stay. This is a time for contractors to proactively make decisions that would help in the smooth running of construction projects.

End.

Sources:

https://www.thenational.ae/uae/government/coronavirus-35-000-passengers-pass-through-abu-dhabi-airport-on-limited-flights-1.1030565https://www.nortonrosefulbright.com/en-me/knowledge/publications/0abd48ed/uae-construction-during-covid19-the-impact-of-government-measureshttps://blog.zoomproperty.com/how-smart-dubai-initiative-will-help-uae-real-estate-to-flourish/https://eres.ae/SIM.aspxhttps://www.cnbc.com/2020/03/18/millions-in-funding-for-scheme-looking-to-transform-construction.htmlhttps://www.khl.com/international-cranes-and-specialized-transport/us-construction-jobs-rebound-in-may/144634.article?utm_source=newsletter&utm_medium=email&utm_campaign=Construction+and+Coronavirus+-+18th+June+2020&utm_term=C%26Chttps://construction.globaldata.com/Analysis/details/analyst-briefing-impact-of-covid-19-on-construction-project-progress-updated-103442https://www.cbnme.com/analysis/lootah-ceo-outlines-top-5-trends-that-will-transform-uaes-real-estate-sector-in-post-covid-19-era/https://www.cbnme.com/logistics-news/dubai-chamber-analysis-examines-changing-consumer-behaviours-in-covid-19-era/https://www.arabianbusiness.com/comment/446623-how-covid-19-will-change-the-way-we-rent-buy-real-estatehttps://www.forbes.com/sites/forbesbusinesscouncil/2020/04/27/how-is-the-business-world-changing-today/#2e663d3e3972https://www.accenture.com/ae-en/about/company/coronavirus-business-economic-impacthttps://meconstructionnews.com/41879/coronavirus-the-waiting-gamehttps://constructionexec.com/article/four-ways-technology-can-help-the-construction-and-freight-industries-labor-shortagehttps://constructionexec.com/article/what-are-the-top-lessons-your-company-has-learned-since-covid-19-has-struck

Mingardi, continued that in particular, infrastructure investments should be directed towards 5G telecommunications, artificial intelligence, ’industrial Internet’, smart cities, education and health care. Di Primio’s Palazzani XTJ52C in Abruzzo model has an outreach of 19.5m, which is being increasingly required in Italy. The main applications are for the installation of 5G masts. The model’s Can Bus system automatically controls movements, leading to time and fuel savings of more than 20%, said the company.

Mingardi, continued that in particular, infrastructure investments should be directed towards 5G telecommunications, artificial intelligence, ’industrial Internet’, smart cities, education and health care. Di Primio’s Palazzani XTJ52C in Abruzzo model has an outreach of 19.5m, which is being increasingly required in Italy. The main applications are for the installation of 5G masts. The model’s Can Bus system automatically controls movements, leading to time and fuel savings of more than 20%, said the company.

New emerging opportunities are increasing in the construction industry with some start ups capitalizing on the need to be online. An example of that is the MENA region’s first electronic store: Rafeeg Store. Rafeeg App founder, Mr.Khamis Al-Sheryani opened this store that specialises in construction, maintenance and decoration projects in the UAE. Through Rafeeg Store, customers can browse the designs of the best international engineers and decorations. They can also easily compare the rates of local contractors who are willing to design their homes. This opening aligns perfectly with the UAE government’s vision to follow through the best environmental practices in various fields, including contracting, maintenance, and design. The online store is now expanding its services in cooperation with a series of trusted international brands to help the market more sustainably in light of the new coronavirus outbreak.

New emerging opportunities are increasing in the construction industry with some start ups capitalizing on the need to be online. An example of that is the MENA region’s first electronic store: Rafeeg Store. Rafeeg App founder, Mr.Khamis Al-Sheryani opened this store that specialises in construction, maintenance and decoration projects in the UAE. Through Rafeeg Store, customers can browse the designs of the best international engineers and decorations. They can also easily compare the rates of local contractors who are willing to design their homes. This opening aligns perfectly with the UAE government’s vision to follow through the best environmental practices in various fields, including contracting, maintenance, and design. The online store is now expanding its services in cooperation with a series of trusted international brands to help the market more sustainably in light of the new coronavirus outbreak.

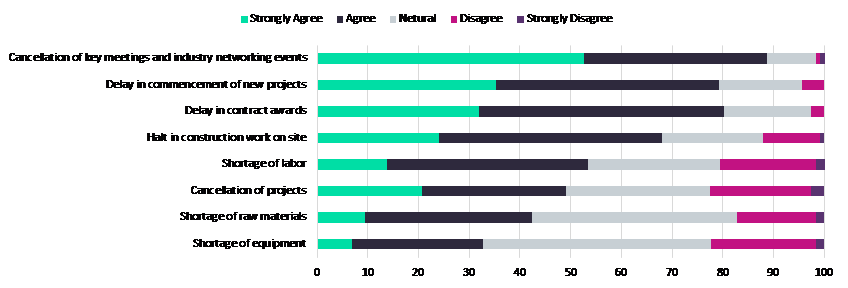

The main challenge for the industry in the short term is that projects that are under construction are being delayed, resulting in a range of legal and financial ramifications for contractors. The risk of project cancellations is also high. The survey shows that 49% of respondents agreed or strongly agreed that COVID-19 had resulted in project cancellations, whereas 78% agreed or strongly agreed that contract awards were being delayed as a result of the outbreak and its impact on investor confidence and general operations.

The main challenge for the industry in the short term is that projects that are under construction are being delayed, resulting in a range of legal and financial ramifications for contractors. The risk of project cancellations is also high. The survey shows that 49% of respondents agreed or strongly agreed that COVID-19 had resulted in project cancellations, whereas 78% agreed or strongly agreed that contract awards were being delayed as a result of the outbreak and its impact on investor confidence and general operations.

Supplier Case Study: The example of NFT

Supplier Case Study: The example of NFT  First step in facing any hazard is to conduct risk assessments and act according to the scientific recommendations to tackle the hazards. Our response covered several aspects to insure safety of our employees as our prime concern, and continuation of flow or work as long as the construction sector is still active in the UAE. We adjusted our modus operandi and adopted several work procedures according to International Recommendations and mitigation measures mandated by the UAE Government. Our updates, guidelines and recommendations come from trusted sources who are experts in the field, such as Department of Health in the UAE, World Health Organization (WHO), or Centers for Disease Control and Prevention (CDC).

First step in facing any hazard is to conduct risk assessments and act according to the scientific recommendations to tackle the hazards. Our response covered several aspects to insure safety of our employees as our prime concern, and continuation of flow or work as long as the construction sector is still active in the UAE. We adjusted our modus operandi and adopted several work procedures according to International Recommendations and mitigation measures mandated by the UAE Government. Our updates, guidelines and recommendations come from trusted sources who are experts in the field, such as Department of Health in the UAE, World Health Organization (WHO), or Centers for Disease Control and Prevention (CDC). From the very early stages, we set up Crises Management Committee formed from out top management, QHSE, Administration, Operations, and HR departments. The job of this committee is to follow up on the current situation, development of COVID-19, contact with UAE officials, contact with our sister companies overseas, and come up with measures in line with the official recommendations. NFT conducted more than 15 dissemination and awareness sessions about the virus and methods to control its spread to different groups in multilanguages. We made sure that the sessions we tailored to each group to reach all our employees and each in their vocation. Special attention sessions and trainings were conducted with sanitation people, drivers, or the more vulnerable groups who can be more exposed as per our risk assessment surveys. In addition, flyers, posters, videos, and publications were circulated wherever possible inside the offices, workshop, vehicles, and even labor camps dormitories.

From the very early stages, we set up Crises Management Committee formed from out top management, QHSE, Administration, Operations, and HR departments. The job of this committee is to follow up on the current situation, development of COVID-19, contact with UAE officials, contact with our sister companies overseas, and come up with measures in line with the official recommendations. NFT conducted more than 15 dissemination and awareness sessions about the virus and methods to control its spread to different groups in multilanguages. We made sure that the sessions we tailored to each group to reach all our employees and each in their vocation. Special attention sessions and trainings were conducted with sanitation people, drivers, or the more vulnerable groups who can be more exposed as per our risk assessment surveys. In addition, flyers, posters, videos, and publications were circulated wherever possible inside the offices, workshop, vehicles, and even labor camps dormitories. Highest risks and challenges occur while commuting to work or living in labor camps that have high concentration of people. With the extraordinary efforts of the health authorities in the UAE, we managed to screen all our working force and implement extra precautions in collaboration of labor camps management. Commuting to work according to the UAE authorities directives, follows 30% occupancy in the vehicles. Effectively it means, we tripled our busses to labor camps, we increased our fleet/trips of small vehicles and minibuses. In addition, we added separate plastic sheet inside the busses in order to separate the driver from the passengers. Deep disinfection is carried out for the whole yard periodically and upon need. On the other hand, all teams were divided into segregated

Highest risks and challenges occur while commuting to work or living in labor camps that have high concentration of people. With the extraordinary efforts of the health authorities in the UAE, we managed to screen all our working force and implement extra precautions in collaboration of labor camps management. Commuting to work according to the UAE authorities directives, follows 30% occupancy in the vehicles. Effectively it means, we tripled our busses to labor camps, we increased our fleet/trips of small vehicles and minibuses. In addition, we added separate plastic sheet inside the busses in order to separate the driver from the passengers. Deep disinfection is carried out for the whole yard periodically and upon need. On the other hand, all teams were divided into segregated  groups that work in isolation from each other. In case any symptoms appear on any of the team members, the one with symptoms would go for check up, while the others in the same team would be sent to self-isolation until further verification of the health conditions. Meanwhile, the job would be carried out with another group, hence keeping work flow uninterrupted.

groups that work in isolation from each other. In case any symptoms appear on any of the team members, the one with symptoms would go for check up, while the others in the same team would be sent to self-isolation until further verification of the health conditions. Meanwhile, the job would be carried out with another group, hence keeping work flow uninterrupted. In parallel, the same measures were conducted to maintain social distancing in the office, when possible the employees could carry out their jobs without the need to come to office. In case coming to office is essential, we restructured the office distribution as to maintain necessary social distancing as recommended. An infrared gun thermometer was placed at the reception for all those entering to voluntarily check their temperatures. A special team is deployed for disinfecting all surfaces, office appliances, door knobs, handles, restroom facilities, round the clock during working hours. Paper circulation was reduced to minimum, and when necessary special disinfected plastic files were used to carry the papers.Masks and gloves are distributed in different types and frequency according to the risk analysis.Special awareness sessions and measures are put in place for the more Vulnerable people (by virtue of their age, underlying health condition, clinical condition or are expecting). They follow the highest strict precautions.Fingerprinting for sign in/out were temporarily deactivated and replaced with photo/ web sign in/out.Provided additional handwashing facilities with soap, and if not available hand sanitizing solutions, especially in vehicles, and at building hallways, entrances, and exits.We increased rubbish bins number and rubbish collection, and spread them in order to reduce any remaining.We reduced site meetings to absolute necessary ones whether external meeting or internal. When possible, we use virtual meetings using technology as Microsoftteams.

In parallel, the same measures were conducted to maintain social distancing in the office, when possible the employees could carry out their jobs without the need to come to office. In case coming to office is essential, we restructured the office distribution as to maintain necessary social distancing as recommended. An infrared gun thermometer was placed at the reception for all those entering to voluntarily check their temperatures. A special team is deployed for disinfecting all surfaces, office appliances, door knobs, handles, restroom facilities, round the clock during working hours. Paper circulation was reduced to minimum, and when necessary special disinfected plastic files were used to carry the papers.Masks and gloves are distributed in different types and frequency according to the risk analysis.Special awareness sessions and measures are put in place for the more Vulnerable people (by virtue of their age, underlying health condition, clinical condition or are expecting). They follow the highest strict precautions.Fingerprinting for sign in/out were temporarily deactivated and replaced with photo/ web sign in/out.Provided additional handwashing facilities with soap, and if not available hand sanitizing solutions, especially in vehicles, and at building hallways, entrances, and exits.We increased rubbish bins number and rubbish collection, and spread them in order to reduce any remaining.We reduced site meetings to absolute necessary ones whether external meeting or internal. When possible, we use virtual meetings using technology as Microsoftteams. Manufacturer Case Study: The example of Terex

Manufacturer Case Study: The example of Terex  The surge of video conferencing is remarkable. An example is the Zoom, who despite scrutiny over security issues, has seen its market value skyrocket to some $35 billion. As people around the world stay home due to coronavirus risk, Zoom has become a go-to service for remote education, exercise classes, games, church services and happy hour celebrations. Couples have gotten married in “zoomed” ceremonies. Birthdays have been celebrated. Funerals have been virtually attended.

The surge of video conferencing is remarkable. An example is the Zoom, who despite scrutiny over security issues, has seen its market value skyrocket to some $35 billion. As people around the world stay home due to coronavirus risk, Zoom has become a go-to service for remote education, exercise classes, games, church services and happy hour celebrations. Couples have gotten married in “zoomed” ceremonies. Birthdays have been celebrated. Funerals have been virtually attended. In addition to the increase in production of PPE and flu fighting supplements and medication, there is an increasing trend of building remote testing facilities by governments. To address the need for testing in urban areas for those without vehicles, CannonDesign architect Albert Rhee created a walk-in testing booth that is slated for public use. Keeping medical professionals healthy during the COVID-19 pandemic is essential in both slowing the rate of infection and meeting heightened staffing needs. Many governments and healthcare providers are finding this to be a difficult task due to the global shortage of personal protective equipment (PPE) supplies. A walk-in testing booth provides an alternative solution that eliminates physical provider-patient exposure in a modular format that is simple to deploy for temporary testing operations. The design is based on testing operations already in place at Yang Ji General Hospital in Seoul, South Korea (featured in this YouTube video). Similar solutions have emerged throughout the world, but design development and production seem to be limited to single-user, single-site applications.

In addition to the increase in production of PPE and flu fighting supplements and medication, there is an increasing trend of building remote testing facilities by governments. To address the need for testing in urban areas for those without vehicles, CannonDesign architect Albert Rhee created a walk-in testing booth that is slated for public use. Keeping medical professionals healthy during the COVID-19 pandemic is essential in both slowing the rate of infection and meeting heightened staffing needs. Many governments and healthcare providers are finding this to be a difficult task due to the global shortage of personal protective equipment (PPE) supplies. A walk-in testing booth provides an alternative solution that eliminates physical provider-patient exposure in a modular format that is simple to deploy for temporary testing operations. The design is based on testing operations already in place at Yang Ji General Hospital in Seoul, South Korea (featured in this YouTube video). Similar solutions have emerged throughout the world, but design development and production seem to be limited to single-user, single-site applications. The Covid-19 pandemic has also pushed some companies to launch new products catering to the fear amongst consumers. Paint manufacturer Caparol has announced a new interior paint product with anti-microbial properties that that it says uses silver ions to bind and destroy the cell membrane of biological contaminants, including bacteria and viruses. Caparol Arabia, the UAE arm of the German paints multinational, claims its ‘CapaCare Protect’ is “an innovative and sustainable solution that provides better protection against harmful micro-organisms”. The new solution, which contains the company’s patented and advanced ‘SILVERbac’ technology, is said to secure walls and surfaces from bio-harm. Since the outbreak of Covid-19, Caparol Arabia says it has launched further testing to check its antimicrobial paint effectiveness at reducing the spread. However, the antibacterial, antifungal and antiviral properties of silver ions and silver compounds have been extensively studied for years.

The Covid-19 pandemic has also pushed some companies to launch new products catering to the fear amongst consumers. Paint manufacturer Caparol has announced a new interior paint product with anti-microbial properties that that it says uses silver ions to bind and destroy the cell membrane of biological contaminants, including bacteria and viruses. Caparol Arabia, the UAE arm of the German paints multinational, claims its ‘CapaCare Protect’ is “an innovative and sustainable solution that provides better protection against harmful micro-organisms”. The new solution, which contains the company’s patented and advanced ‘SILVERbac’ technology, is said to secure walls and surfaces from bio-harm. Since the outbreak of Covid-19, Caparol Arabia says it has launched further testing to check its antimicrobial paint effectiveness at reducing the spread. However, the antibacterial, antifungal and antiviral properties of silver ions and silver compounds have been extensively studied for years.

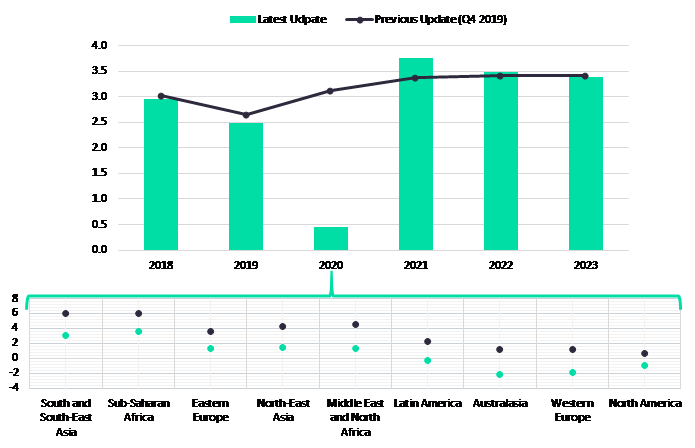

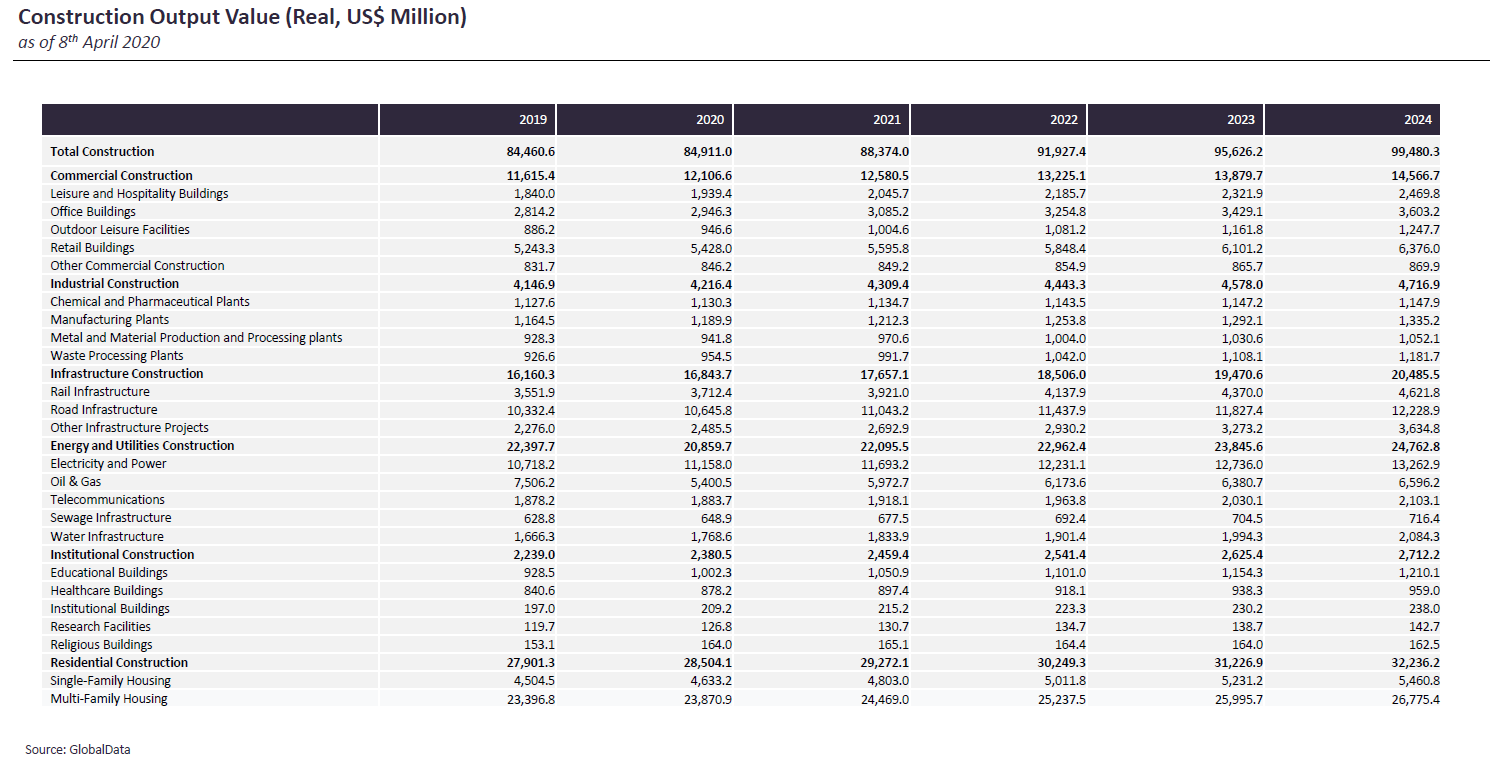

Given the severe disruption in China and other leading economies worldwide following the COVID-19 outbreak, GlobalData’s forecast for construction output growth in 2020 has been revised down to 0.5%, compared to the previous forecast of 3.1% growth (in the Q4 2019 update).

Given the severe disruption in China and other leading economies worldwide following the COVID-19 outbreak, GlobalData’s forecast for construction output growth in 2020 has been revised down to 0.5%, compared to the previous forecast of 3.1% growth (in the Q4 2019 update). This package is intended to support banks and businesses during the Coronavirus crisis for up to six months. Experts in the field say this package will be beneficial for the local construction sector, which includes small and medium-sized design and contracting enterprises. The UAE government has managed to suspend social activities without a severe effect on economic output. In the construction sector, remote working, which some private sector employers in the UAE have voluntarily offered, could impact administrative procedures that are essential for site works to progress, such as sign-offs and schedule management. Meanwhile, even though cargo travel currently faces fewer restrictions than passenger flights, supply chain disruptions are likely to deepen in the weeks ahead. China – the world’s largest exporter and the epicentre of COVID-19 – has only just begun a slow recovery after its factories were shut down for almost two months to curb the spread of the virus.

This package is intended to support banks and businesses during the Coronavirus crisis for up to six months. Experts in the field say this package will be beneficial for the local construction sector, which includes small and medium-sized design and contracting enterprises. The UAE government has managed to suspend social activities without a severe effect on economic output. In the construction sector, remote working, which some private sector employers in the UAE have voluntarily offered, could impact administrative procedures that are essential for site works to progress, such as sign-offs and schedule management. Meanwhile, even though cargo travel currently faces fewer restrictions than passenger flights, supply chain disruptions are likely to deepen in the weeks ahead. China – the world’s largest exporter and the epicentre of COVID-19 – has only just begun a slow recovery after its factories were shut down for almost two months to curb the spread of the virus. It is anticipated that the timeline will be at least 10 months away, meaning that hygienic and exposure-control measures will continue to be the first line of defense for most governments. In many countries around the world, hospitals or care facilities are emerging over night as the number of infected cases increased.

It is anticipated that the timeline will be at least 10 months away, meaning that hygienic and exposure-control measures will continue to be the first line of defense for most governments. In many countries around the world, hospitals or care facilities are emerging over night as the number of infected cases increased.